January 2, 2018 – Jon Peddie Research (JPR), the industry's research and consulting firm for graphics and multimedia, today released its latest quarterly report on the Visual Processing Unit (VPU) market.

The major interest and activity in the market for Vision Processing Units (VPUs) continues to center on neural networks, both in terms of advances in the networks themselves and in the continuing entry of new architectures and participants into the field.

Even taking into account the consolidation of three large companies (NXP, Freescale and Qualcomm) into one and the absorption of Nervana, Movidius and Mobileye into Intel, the number of companies we are tracking has increased compared to this time last year. Growth is not limited to one country but Chinese startups are beginning to make a strong showing.

The promised introduction of new architectures specifically designed for neural networks is moving closer. With new details of the architectures being released, it is becoming clear that while there are many differences between them, these new architectures share some fundamental characteristics. All of them in some way target efficient execution of a statically scheduled graph so perhaps the generic term for this new class of device is 'Graph Processor'.

New devices for the datacenter uniformly compare themselves against Nvidia's repurposed GPU. Benchmark predictions (which are still all we have) claim dramatic improvements in efficiency for compute-intensive applications and, more worryingly for the GPU vendors, claim to be able to meet latency targets that are beyond the reach of a GPU. Similar claims are being made with regard to new architectures versus repurposed DSPs in the embedded inference market (but we have even less evidence in those cases). It is possible that we are seeing the start of a maturation process where the first generation solutions cobbled together from existing parts are replaced by custom designs. It is certain that new entrants will continue to push towards that goal.

Nearly every hardware IP company now has a core aimed at neural network inferencing: Imagination Technologies became the latest player which means the only major holdout is Arm. Without disputing that the market for inference devices is there, Arm argues that the time is not yet right to make hardware bets and that there is enough for it to do in optimizing its CPUs for the new workloads. It's the sort of question where both sides can be right, but the disagreement illustrates the preliminary and developing nature of the VPU market.

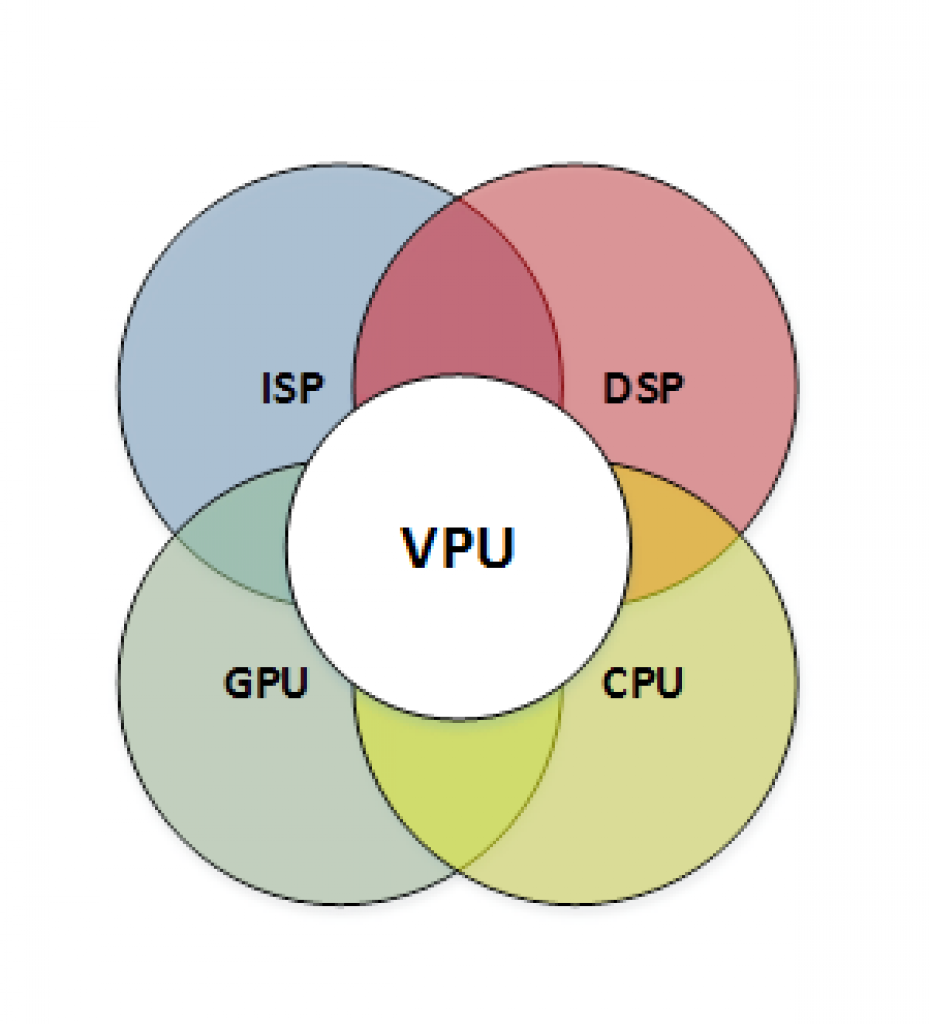

Figure 1: JPR – VPUs are at the center of advanced image processing, CNNs, and augmented reality

The VPU is a relatively new device but the field is already crowded with established companies bringing previous experience in DSP and GPU design to bear, as well as many startups.

We have identified 38 companies that are making VPU capable processors using GPUs, DSPs, and dedicated engines. Companies such as Intel, TI, Nvidia, AMD, and Qualcomm, don't invest millions of dollars in R&D and acquisitions unless they see a big return. Therefore, no semiconductor, system builder, or software tool, or application developer can afford to ignore this emerging, perhaps explosive, market.

This issue summarizes and contrasts technologies from two very different companies: Imagination Technologies and Deephi. Imagination is a heavyweight of the silicon IP industry, with a track record of success in the GPU and video codec market but now facing severe challenges whereas Deephi is one of a new breed of Chinese startups. Deephi is a solution provider basing its products on in-house developed technology and is taking a very pragmatic bottoms-up approach by targeting custom silicon at the specific verticals that are important to existing businesses. Heavyweights like Alibaba are their customer base along with others in the Chinese market for inference in the cloud and at the edge.

Whereas Imagination has no ambition to produce its own silicon, preferring to remain in the world of IP, Deephi has very definite plans in that direction. Its current crop of products are all in FPGA today but the company has stated that it intends to turn those designs into ASICs over the coming year. This focus on supplying complete solutions directly to customers in targeted verticals has led Deephi into a very different design philosophy than IP companies (and broad range semiconductor companies in general). Their approach is to design specific accelerators tailored to specific classes of problem and deploy those for specific companies whose end-goals are encoded into the silicon. It's an approach that has been eschewed by western Semicos for decades because of the NRE costs and limited market for each vertical. Deephi is making progress with an FPGA approach but can they be successful when they move to ASIC?

The market for VPUs with deep learning continues to explode, with new applications coming out of the woodwork all the time and no shortage of startups throwing their hats into the ring. Even so, 2017 has seen consolidation of a sort, with Intel continuing its attempts to gain a foothold in the automotive market by acquiring Mobileye while Qualcomm's ingestion of NXP (if it happens) will surely affect the fortunes of Freescale's current IP supplier VeriSilicon one way or another.

One company that has been conspicuous by its absence is Arm and we present here a summary of a conversation where they lay out some perspectives on their approach to the machine learning market.

Challengers to Nvidia's dominance in the cloud continue to make progress and we look at the latest news from one of the most interesting of those: Graphcore.

JPR's quarterly VPU report provides the in-depth information needed to access opportunities, suppliers, and competitors.

JPR's new quarterly VPU service analyzes the suppliers, the technology, the processors, and the market opportunities. As robust as the market is, there will be consolidation through either failures or acquisitions, and we think there will be just a half dozen suppliers, three major companies, and three niche players by 2020.

Where will your supplier, company, or competitors be in 2020? JPR's VPU report can help assess those opportunities and threats.

Pricing and Availability

Jon Peddie Research's VPU Report is available now sells for $2,500. The annual subscription price for JPR's VPU report is $6,500 and includes four quarterly issues. Full subscribers to JPR services receive TechWatch (the company's bi-weekly report) and are eligible for a 10% discount. Bundle packages are also available. For information about purchasing the VPU Report, please call 415/435-9368 or visit the Jon Peddie Research website at www.jonpeddie.com.

About Jon Peddie Research

Dr. Jon Peddie has been active in the graphics and multimedia fields for more than 30 years. Jon Peddie Research is a technically oriented multimedia and graphics research and consulting firm. Based in Tiburon, California, JPR provides consulting, research, and other specialized services to technology companies in a variety of fields including graphics development, multimedia for professional applications and consumer electronics, high-end computing, and Internet-access product development. Jon Peddie's Market Watch is a quarterly report focused on the market activity of PC graphics controllers for notebook and desktop computing.