This market research report was originally published by Counterpoint Technology Market Research.

- In 1Q20, the penetration of quad-camera smartphones reached almost 20% of global smartphone shipments.

- OPPO, Xiaomi, Huawei, and Samsung together accounted for 83% of nearly 60 million quad-camera smartphone shipments during Q1.

- Realme was the most aggressive adopter of quad-camera designs, with penetration reaching up to two-thirds of its shipments during the quarter.

- The trend toward multi-cameras will continue; smartphone CMOS Image Sensors (CIS) shipments in 2020 will likely register high-single-digit growth.

The COVID-19 pandemic has made a clear impact on the global smartphone industry, and the market is expected to be dragged down to the level of shipments in 2014, slightly over 1.3 billion units, representing a nearly 10% year-on-year decline vs 2019.

However, as a beneficiary of the continuous improvement in technology and feature sets, the sales volume of CMOS image sensors (CIS) for smartphone applications increased eightfold over the past decade, reaching more than 4.5 billion units in 2019.

Commenting on this trend, Senior Analyst Ethan Qi, noted, “Although the strong growth momentum is expected to soften amid the pandemic fallout, thanks to the irreversible trend towards multi-camera setups and the spreading adoption of 3D sensing systems, the smartphone CIS segment will likely still register high-single-digit shipment growth in 2020, hitting an all-time high of close to 5.0 billion units.”

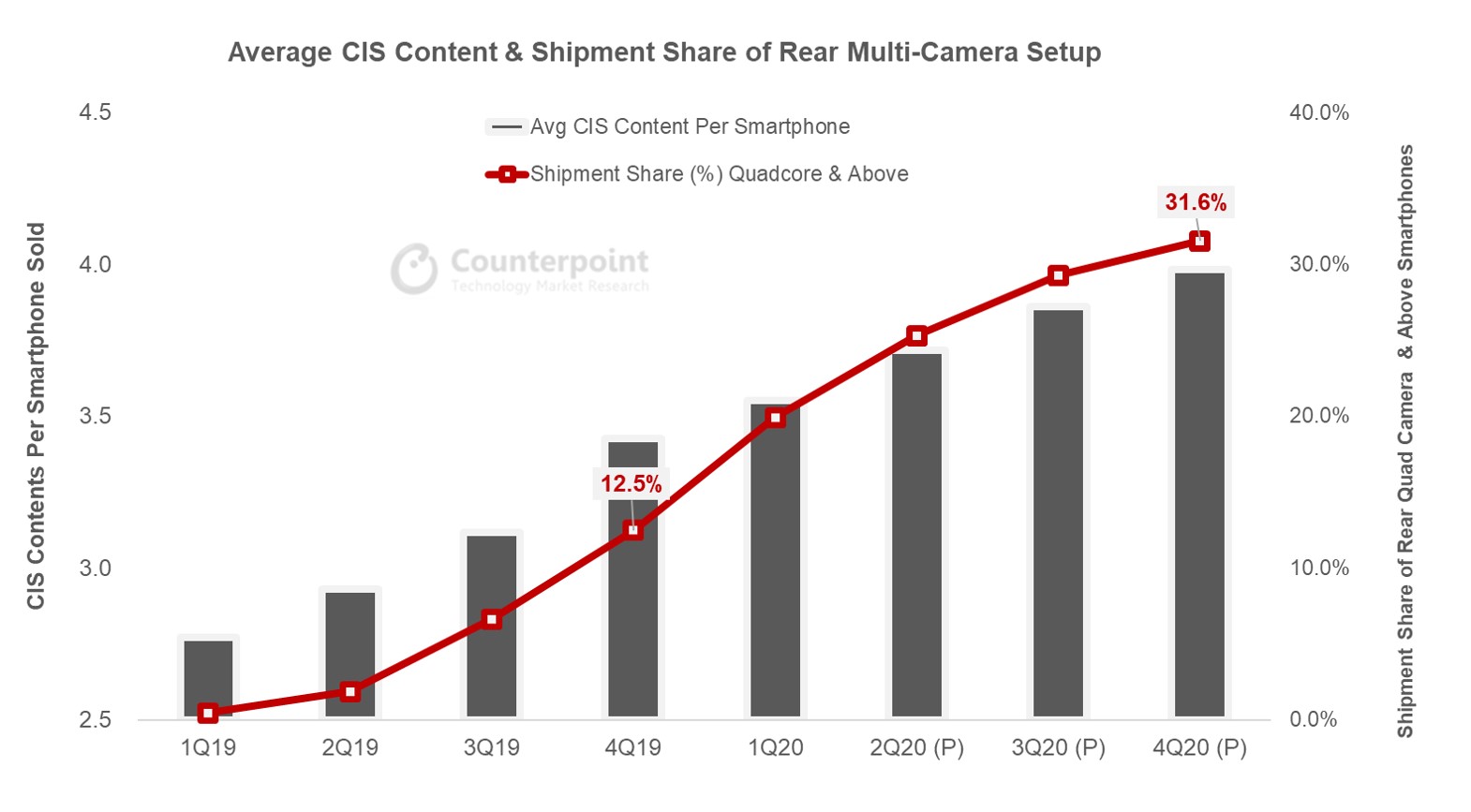

Exhibit 1: Smartphone industry continues the trend towards multi-camera systems

According to the findings of Counterpoint’s Component Tracker, each smartphone shipped in 1Q20 packed more than 3.5 image sensors on average. The growth is primarily driven by the rising penetration of quad-camera designs in the high- to mid-end smartphones, which jumped to nearly 20% during the period.

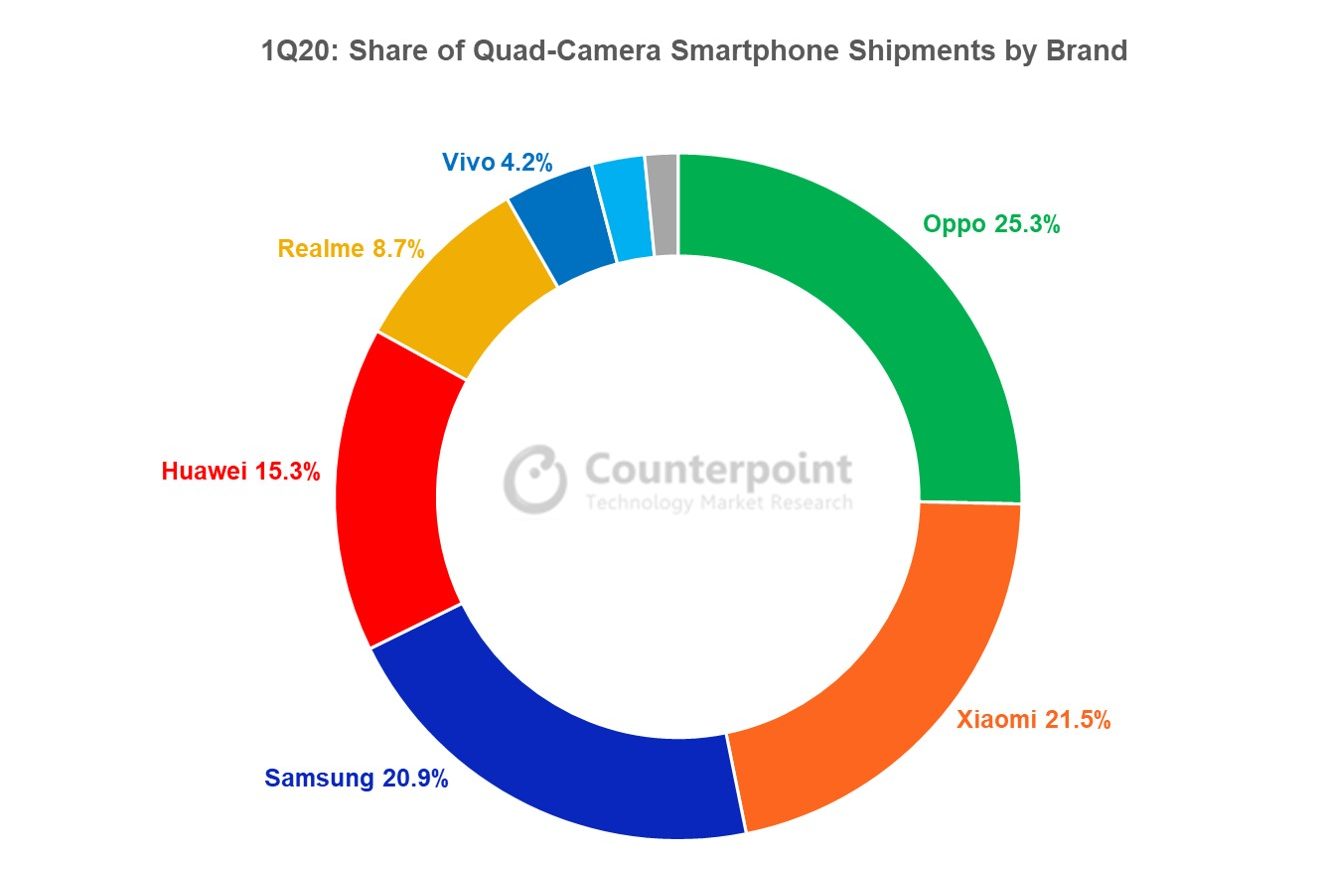

Exhibit 2: OPPO, Xiaomi and Samsung Led the Quad-camera Race

Chinese smartphone brands OPPO, Xiaomi, Huawei, as well as Samsung were at the forefront of adopting quad-camera setups, collectively accounting for 83% of all the quad- and penta-camera-based smartphone shipments during Q1 2020.

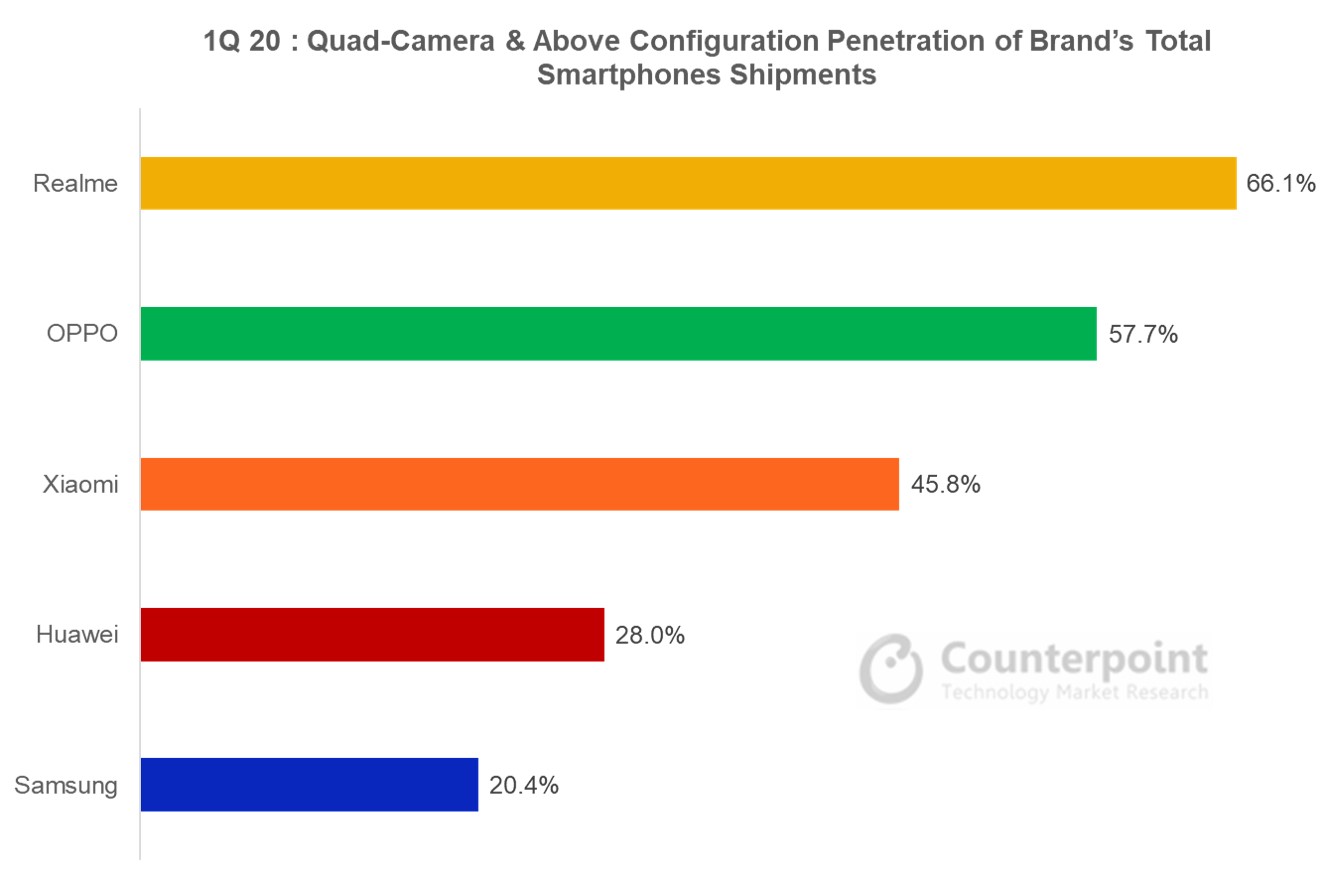

Looking at the quad-camera and above setup at the brand level, the fast-growing young brand Realme was the most aggressive brand to ride on this trend. Almost two-thirds of its smartphone volumes in Q1 packed a quad-lens system. The next brand squeezing more camera sensors into the rear camera module was OPPO accounting for more than half of its smartphones shipped in Q1 2020. Xiaomi trended above the market average, whereas Samsung and Huawei, which are still selling lots of lower-end models, had quad camera systems in less than a third of their smartphones shipped during the quarter.

Commenting on the importance of camera in smartphones, Research Director, Tom Kang, highlighted, “As camera function has become a key differentiator in smartphones, we expect the quad-camera feature will become a standard moving forward. Leading smartphone brands will continue enriching and enhancing the photography and video capture experiences, as well as exploring AR applications, by leveraging diversified lens and sensor combinations along with the increasing AI computing power.”

Meanwhile, new technologies will continue to emerge to ease the cost pressure. For example, Immervision, a Canadian company specializing in wide-angle optics and image processing algorithms, is developing an innovative wide-angle design, which enables sharing the high-megapixel main camera for panorama capabilities.

Ethan Qi

Research Analyst, Counterpoint Mobile and Semiconductors