This market research report was originally published at Yole Développement’s website. It is reprinted here with the permission of Yole Développement.

Q2 2021 Technical Dynamics:

-

Huawei ban, COVID-19 pandemic and semiconductor shortage have strongly impacted the CIS industry.

-

2020 saw CIS revenues reach US$20.7 billion with an annual growth of 7.3%.

-

Expectation for 2021 is to experience slower growth at 3.2% YoY. Nevertheless, the market will reach a record value of US$21.4 billion.

-

Sony, Samsung and OmniVision are still occupying the top 3 ranking with 73% of the total CIS market revenue in 2020:

-

Sony was the main CIS player to suffer from the Huawei ban, with a major drop in CIS revenue in Q4 2020 and Q1 2021.

-

Samsung and OmniVision have benefited strongly from this combination of events.

-

-

Having access to specific production lines could be important for CIS players in the coming years.

COVID-19 Was Not the Fox Among the Chickens

CIS revenues reach US$20.7 billion in 2020, with a 7.3% annual growth. As with other semiconductor products, Yole Développement (Yole)’s analysts noted that long production cycles and the activity of markets such as consumer, automotive, security, and industrial led to challenges in procurement of CIS at the end of 2020.

In 2021, Yole’s imaging team expects a more stable situation. Q1 2021 has been very good due to some production overflow identified from Q4 2020, leading to a 7% better quarter compared to Q1 2020.

“Q1 is seasonally a typically lower revenue quarter, though there was fear of shortages in the overall semiconductor industry”,explains Chenmeijing Liang, Technology & Market Analyst within the Photonics, Sensing & Display Division at Yole. “At Yole, we believe that the effect here is more linked to supply chain issues rather than real capacity issues for CIS.”

2020 was a very unusual year for the CIS industry, without doubts.

Everybody had the COVID-19 situation in mind. Indeed, it created a temporary disruption in the supply chain which had to be made up towards year-end. But more than that, another disruptive aspect was the Huawei ban and its effect on the market between Q3 2020 and Q4 2020, especially for Sony. However, it did not lead to a CIS market collapse thanks to the increasing number of cameras per mobile and a stable average selling price overall.

All these events combined allowed for the CIS industry to maintain significant growth in 2020.

A Supply Chain Disruption or a Battle Between Leading CIS Companies?

“Sony was hit the hardest by these crises, as it was highly exposed to the mobile market and subsequent international trade tensions; the toll on Sony’s revenue in Q4 2020 is notable”,asserts Pierre Cambou, Principal Analyst in the Photonics and Sensing Division at Yole.

Sony, of course, remains the market leader, and though they did lose some market share in Q4-2020, they regained traction in Q1-2021. However, they are being challenged by increased competition. In comparison, their nearest competitor Samsung was more protected from this market shake-up due to its vertical integration. Their recently released line of 0.7µm pixel sensors targeting the mobile market helped them seize some of the new opportunities, with some OEM s, such as Xiaomi, benefiting from Huawei’s disappearance.

At the same time, the Huawei ban had other impacts on the overall supply chain… Full story in COVID-19 & Huawei ban winds of change on the CIS industry – Quarterly Market Monitor article.

What’s Next?

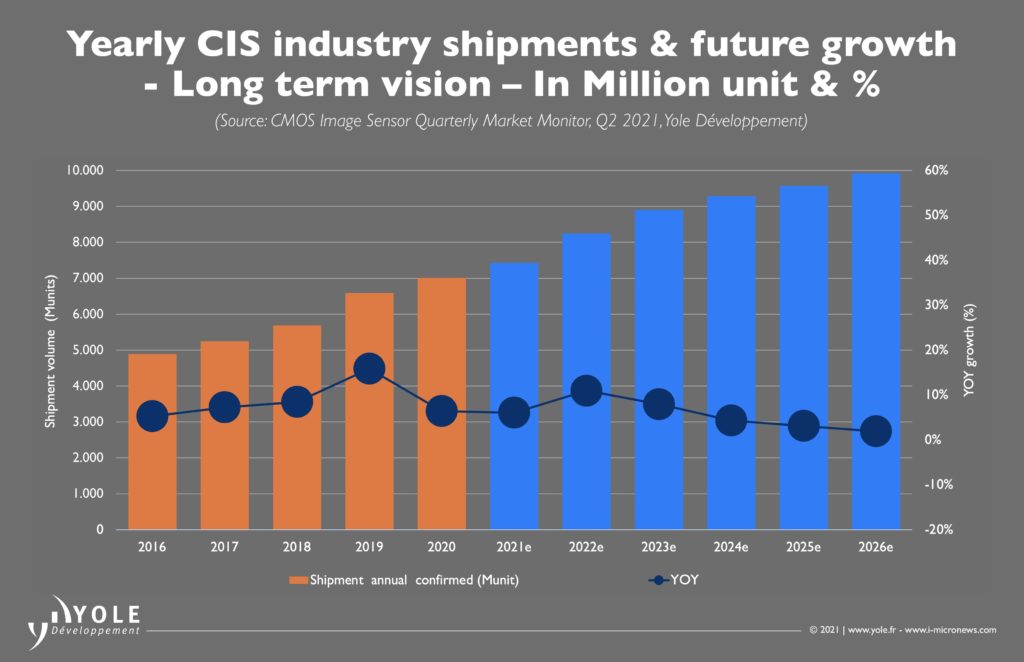

The long-term view is that the CIS market could gradually come to match the growth rate of the semiconductor market in general. This leads Yole’s analysts to expect a 5.4% CAGR over the next five years to a total market of US$28.4 million in 2026. As explained, 2021 will be steadier, but we expect a strong bounce-back for the CIS market in 2022 with a 9% annual growth. Thus, the outlook is exciting, with an uptick in the automotive, security, and industrial camera markets, while smartphone sales are expected to remain stable though with an increase in the average number of cameras in each. But can the worldwide capacity set itself up to match the market demand?

Forget the 3nm technology race; in a context of high competition for 90nm down to 28nm nodes, the battle to secure CIS production capacity will become even more interesting.

The size and dynamics of the main CIS markets and players led Yole’s analysts to the conclusion that a CIS quarterly market monitor was essential to monitor and provide a better understanding of the short- and medium-term trends. Yole’s imaging and sensing team also deliver several annual dedicated reports.

Discover them on i-Micronews.

In addition, do not miss the 4th Yole Développement and CIOE forums on LiDAR and on 3D Sensing for Consumer, respectively on September 1st and 2nd in Shenzhen, China, or online.

Register HERE to discuss with key players about key technology for the automotive industry and HERE for the bright future of 3D sensing.

Stay tuned on i-Micronews to follow our imaging activities including webcasts, articles, interviews, reports and more!

Acronyms:

- CIS: CMOS Image Sensor

- YoY: Year-over-Year

- OEM: Original Equipment Manufacturer

- CAGR: Compound Annual Growth Rate