Industrial, consumer and automotive are driving the adoption of neuromorphic with first products.

OUTLINE:

-

Market forecasts:

The neuromorphic sensing market will reach up to US$5 billion by 2030, with a 116% CAGR between 2025 and 2030.

The neuromorphic computing market will reach US$2 billion in 2030, with a CAGR2025-2030 of 88%.

The three main segments will be consumer, industrial and automotive

Until 2025, neuromorphic for industrial applications will remain a niche market with US $2 billion in 2030 for computing and sensing combined.

Yole Développement (Yole) announces the mobile and other consumer applications will reach US $2.8 billion in 2030.

Neuromorphic computing for automotive will reach US $2 billion in 2030.

-

Technology trends:

Nowadays, there is a strong need for power-efficient technologies to handle in a sustainable manner demanding AI workloads.

Neuromorphic technologies are a promising answer to this need as they can perform challenging AI tasks very efficiently.

-

Supply chain:

The neuromorphic ecosystem consists today of three main categories of players: university & research institute, labs affiliated to large companies and start-ups.

Intel and IBM developed neuromorphic communities around their chips to help the software ecosystem grow.

“AI is hungry for performance, and Moore’s law dynamics will not suffice to cover the needs of the ongoing 5G/IoT /AR /Robotic revolution. The ecosystem is and will stay R&D-oriented for the next 3 to 5 years.” asserts Adrien Sanchez, Technology & Market Analyst, Computing & Software division at Yole Développement (Yole).

He adds: “Brute force is currently being used to leverage the power of AI, but this approach is not scalable. It will hit a heat wall, a data wall, and a cost wall related to the ability of the semiconductor industry to deliver at a certain pace, Moore’s law, the incremental cost to performance improvements”.

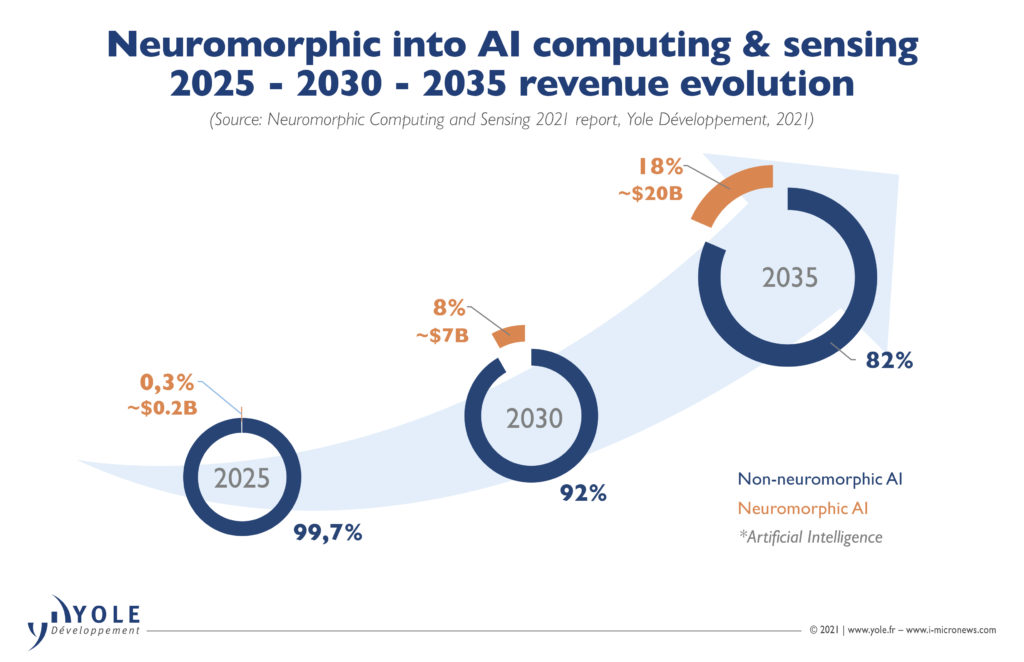

Current AI computing will not deliver, so what AI technology would be necessary? Neuromorphic computing and sensing solutions, drawing inspiration from what happens in the brain, have key specificities to compete within the existing AI landscape and constraints. These technologies will address most of the current challenges and could represent 20% of all AI computing & sensing by 2035.

In this context, Yole investigates disruptive technologies and related markets in depth, to point out the latest innovations and underline the business opportunities.

Released today, the Neuromorphic Computing and Sensing 2021 report, delivers an in-depth understanding of the neuromorphic ecosystem, and presents key technical insights and analyses regarding future technology trends and challenges.

Including market trends and forecasts, supply chain, technology trends, technical insights and analysis, take away and outlook, this study also delivers an in-depth understanding of the ecosystem and main players’ strategies.

What is the status of the neuromorphic ecosystem? What are the economic and technological challenges? What are the key drivers? Who are the players to watch, and what innovative technologies are they working on?

Yole presents today its vision of the neuromorphic computing and sensing technologies and the emerging applications behind.

As analyzed by Yole’s team in the new Neuromorphic Computing and Sensing 2021 report, industrial applications will be the first to use neuromorphic technologies, driven by high speed, low latency, and offline learning enabling more autonomous features and performance. Players such as Prophesee, Brainchip, and Nepes AI/ General Vision already have products in the market targeting industrial applications, and more players will follow in the coming years. The consumer market will also benefit from neuromorphic technologies enabling more AI applications at the edge on battery-powered devices, ensuring privacy and safety of personal data.

According to Simone Bertolazzi, PhD, Senior Technology & Market analyst, Memory, at Yole: “Current neuromorphic device architectures can also vary significantly with respect to the organization of the memory and computing components on the silicon chips. There is currently a clear trend towards “in-memory-computing” solutions: several companies are developing designs with mainstream embedded memory, like SRAM, distributed across cores or neurons; various players are also considering the adoption of emerging NVM elements assembled in crossbar arrays, leveraging the “synapsis-like” properties of resistive memories, for example PCM, OxRAM, CBRAM”.

For Pierre Cambou, MSc, MBA, Principal analyst in the Photonics and Sensing Division at Yole: “In the automotive market, a host of applications will benefit from the low latency and low power consumption of neuromorphic technologies. While it will take longer for neuromorphics to be adopted in this promising yet challenging market, some projects have already been announced, such as Xperi’s Driver Monitoring System and Terranet’s ADAS cameras and laser.”

Additionally, the cloud server market could also benefit from neuromorphic computing technologies, leveraging low latency and online learning to improve the performance of applications such as cybersecurity and fraud detection. The considerable power efficiency could also help to limit the power consumption growth in data centers which is a growing concern. Large players such as Intel and IBM are already creating neuromorphic server prototypes by assembling their massively scalable Loihi and TrueNorth chips, respectively.

The neuromorphic ecosystem is today very dynamic with three main categories of players: university & research institute, labs affiliated with large companies, and start-ups. The latter are the first players to bring products to the market for edge computing, targeting industrial, automotive, and consumer applications. They will test new approaches in the market in a real-life environment.

From their side, universities are forming extensive collaborations, often supported by governments, to develop the technology and understand the hard-science potential. This covers a vast range, starting from a simulation of the brain on a silicon chip, and involves partnerships with various companies to develop proofs-of-concept in the field. Labs affiliated with large companies are deeply involved in these collaborations and often take the lead. Intel and IBM developed neuromorphic communities around their chips to help the software ecosystem grow, increase the maturity of neuromorphic AI, and test use cases directly with application players.

Acronyms:

- AI: Artificial Intelligence

- IoT: Internet of Things

- AR: Augmented Reality

- NVM: Non-Volatile Memory