This market research report was originally published at Yole Développement’s website. It is reprinted here with the permission of Yole Développement.

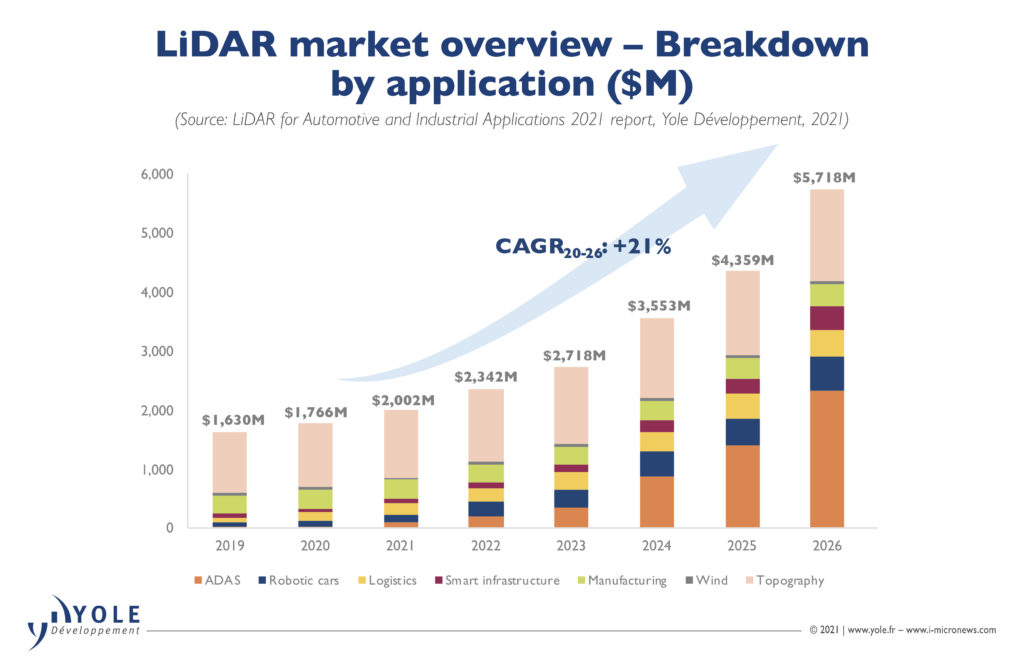

ADAS and robotic vehicles will drive the LiDAR market from US$1.8 billion in 2020 to US$5.7 billion in 2026.

OUTLINE:

-

Market forecasts:

During several years, Audi was the only OEM integrating LiDAR, but things are expected to accelerate…

Automotive LiDAR market is expected to grow to US$2.3 billion in 2026 at a 111% CAGR between 2020 and 2026.

Lines are starting to move for the industrial LiDAR: smart infrastructure and logistics are showing the highest growth, reaching US$500 million each by 2026.

-

Supply chain:

Market shares evolution: 2020 changes have been modest. Revenues for the main large LiDAR companies have declined in 2020.

Several Tier-1s are actively involved in LiDAR: Valeo in Audi cars, Continental with the flash LiDAR etc…

Design wins: the majority are for Valeo. This makes this company, by far, the leading LiDAR supplier in ADAS vehicles.

More robotic car companies are now involved in LiDAR development: Waymo, Argo AI and Cruise… are part of the playground.

In 2020 and 2021, several LiDAR companies targeting mainly automotive applications have become public.

“The market for LiDAR in automotive and industrial applications is expected to reach US$5.7 billion in 2026, showing a significant 21% CAGR between 2020 and 2026”, asserts Alexis Debray, PhD. Senior Technology & Market Analyst, Photonic, Sensing & Semiconductor at Yole Développement (Yole). “In 2020, the LiDAR in ADAS represented only 1.5% of the automotive and industrial LiDAR market. But the ADAS proportion is expected to reach 41% in 2026.”

Therefore, the market research & strategy consulting company, Yole announces an impressive 111% CAGR during the 2020-2026 period, for this market segment.

In that context, it will reach a market size of US$2.3 billion. In parallel, the growth in robotic cars, including robotaxis and autonomous shuttles, is expected to be less impressive but still important. This segment is expected to reach US$575 million in 2026 with a 33% CAGR during the same period..

In the industrial market, smart infrastructure and logistics are expected to see an higher growth. The smart infrastructure LiDAR market will reach US$395 million in 2026 with a 35% CAGR between 2020 and 2026. The logistics LiDAR market will reach US$466 million in 2026 with a 23% CAGR during the same period again. In smart infrastructure, smart city applications are expected to be most important segment to look at.

Security, highway monitoring and autonomous checkout are other important applications. In logistics, autonomous trucks and delivery robots are expected to have the most significant growth.

Yole releases today its annual LiDAR technology & market report, titled LiDAR for Automotive & Industrial Applications. With this 2021 edition, Yole’s analysts propose an update of their market analysis by adding new focus on the supply chain, industrial applications, software & computing for ADAS, key LiDAR companies as well as additional reverse costing analyses. Aim of Yole’s LiDAR report is to deliver valuable market metrics and dynamics and offer an application-oriented focus on key existing market and the most promising emerging ones. Analysts reveal their deep understanding of the LiDAR business value chain, infrastructure and players. And they took a step back to analyze the major technology trends and their impact on the industry.

Since the invention of 3D real-time LiDAR by David Hall from Velodyne in 2005, more than 80 LiDAR companies have been established, reminds Yole in its report. Many of them have bet on new technologies. This has resulted in high technological diversity in the LiDAR landscape.

“Despite this great diversity, the oldest technologies are still representing most design wins for the automotive industry,” explains Pierrick Boulay, Senior Technology & Market in the fields of Solid-State Lighting and Lighting Systems at Yole. And he adds: “Considering the LiDAR wavelength, 1550nm is less dangerous to the human eye than 905nm and promises integration through the silicon platform. However, 905nm represents 65% of design wins for the automotive industry.”

For the imaging method, traditional mechanical scanning represents 69% of design wins. MEMS micromirror and Flash LiDAR are also making their way into automotive, but their proportion is smaller.

Concerning the ranging method, direct dToF represent 100% of design wins. FMCW , which allows better integration, sensitivity, and instant radial velocity, is not expected before 2025. The identification of LiDAR design wins and their detailed analysis with a relevant segmentation is unique. This year, Yole’s analysts took the time to make the direct link between technical innovations and applications, especially in the automotive domain. With their technical and market expertise, they identified the design wins and analyzed them, one by one to give an impressive evaluation and define rankings. Without doubts, among the overall design wins made public, 8 have been created by Valeo. This makes the French Tiers-1, by far, the leading LiDAR supplier in ADAS vehicles today. What will be the next steps?…

All year long, Yole Développement is publishing numerous Sensing & Actuating, Photonic and Imaging reports. In addition, analysts realize various key presentations and organize key conferences.

Do not miss the 4th Yole Développement and CIOE forums on Imaging & LiDAR for Automotive Forum 2021, on September 1st, and on 3D Sensing for Consumer 2021, on September 2nd in Shenzhen China and online. Register today!

Make sure to be aware of the latest news coming from the industry and get an overview of our activities, including interviews with leading companies and more on i-Micronews.

Stay tuned!

Extracted from:

- LiDAR for Automotive and Industrial Applications report, Yole Développement, 2021

Acronyms:

- CAGR : Compound Annual Growth Rate

- ADAS : Advanced Driver Assistance Systems

- ToF: Time-of-Flight

- FMCW: Frequency Modulated Continuous Wave