This market research report was originally published at Yole Développement’s website. It is reprinted here with the permission of Yole Développement.

Yole Développement (Yole) identifies new applications in a dynamic market bringing growth and opportunities for lots of companies…

OUTLINE:

-

Market forecasts by applications:

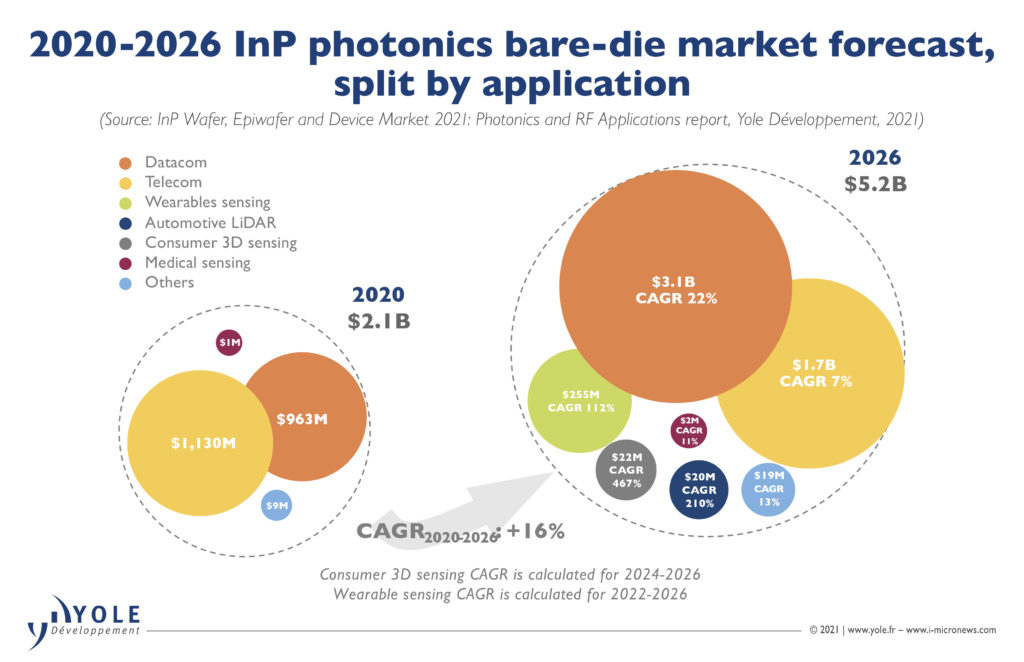

Growth in datacom & telecom applications will drive the InP market in the next 5 years. CAGR between 2020 and 2026 are respectively 22% and 7%.

Emerging InP applications such as LiDAR for automotive, 3D sensing and wearables are showing impressive CAGR: 210%, 467% and 112% respectively.

-

Technology trends:

The main technology used today in optical communication applications is DFB with more than 63% of the market share.

InP EEL process yields are still low, hampering economy-of-scale.

The demand for transceivers with high transmission rates exceeding 400GBps will drive technology advancement in single lasers and integrated devices.

-

Supply chain:

II-VI and Lumentum are leading the InP bare-die market.

LandMark continues to dominate the InP epiwafer market, with more than 60% of the open epiwafer market share.

Sumitomo and AXT continue to lead the wafer market with more than 75% of combined market share.

China has been investing heavily in optical infrastructure with a massive deployment of 5G transceivers.

Due to US-China trade war and COVID 19 pandemic, many laser & photonics companies lost big customers…

“At Yole, we expect an initial slight market penetration of InP in 2022 in wearables, followed by a significant increase to US$255 million in 2026 with a CAGR2022-2026 of 112%.” asserts Ahmed Ben Slimane, PhD, Technology & Market Analyst, Compound Semiconductors and Emerging Substrates at Yole Développement (Yole). He adds:“For LiDAR applications, InP could be promising, enabling eye safety at higher wavelengths. Leading companies such as Volvo, ZF, Continental, Daimler, etc. are interested in adopting InP-based LiDAR .”

For smartphones, OLED displays are transparent at wavelengths in the range of 13xx to 15xxnm, explains Yole’s analyst. OEMs interested in removing the camera notch on mobile phone screens and integrating the 3D-sensing modules under OLED displays are considering moving to InP EELs, replacing the current GaAs VCSELs. Even though this trend is currently in an early R&D phase, Yole sees a strong interest from several players, such as ams, Infineon Technologies, STMicroelectronics and several laser manufacturers and sensor players.

In this context, the market research and strategy consulting company investigates disruptive technologies and related markets in depth. Its aim is to point out the latest innovations and underline the business opportunities.

Released today, the InP Wafer, Epiwafer and Device Market 2021: Photonics and RF Application report delivers a comprehensive and detailed understanding of the InP industry, covering markets from wafers and epiwafers to bare dies. Including market trends and forecasts, supply chain, technology trends, technical insights and challenges analysis, take away and outlook, this study proposes an in-depth description of the ecosystem and main players’ strategies.

What are the economic and technological challenges of this industry? What are the key market drivers? Who are the companies to watch, and what innovative technologies are they working on? What are the recent investments, mergers, and acquisitions?… Today, Yole’s compound semiconductors and emerging substrates analysts present their vision of the InP industry.

As analyzed by Yole’s team in the new InP Wafer, Epiwafer and Device Market 2021: Photonics and RF Application report, as an indispensable building block for high-speed and long-range optical transceivers, InP laser diodes remain the best choice for telecom & datacom photonic applications. However, following the COVID-19 outbreak and the US-China trade tensions, telecom infrastructure deployment was disrupted, resulting in a minor InP market slowdown in 2020. The requirement for more data transfer at higher speed in datacom is increasing, with technology migrating to single InP lasers targeting state-of-the-art 100 Gbps output, making them preferable in 400Gbps and 800Gbps transceivers.

Driven by high volume adoption of high data rate lasers, the datacom bare die market reached around US$963 million in 2020. It is expected to be worth US$3.1 billion in 2026 at a 22% CAGR during this period.

Meanwhile, the cyclic InP telecom market will continue its growth thanks to 5G deployment. Yole sees a comfortable increase from US$1.1 billion in 2020 to US$1.7 billion in 2026 at a CAGR2020-2026 of 7%.

The InP industry is a dynamic market with lots of opportunities for legacy players and new entrants. In its InP technology & market analysis, Yole reports a fragmented market, with numerous companies, especially at the device level.

According to Ahmed Ben Slimane from Yole: “Two American players are leading the InP market: II-VI and Lumentum. Both have increased their market share and strengthened their position thanks to strategic mergers and acquisitions. Indeed, II-VI acquired Finisar in 2019, and Lumentum acquired Oclaro in 2018.”

II-VI and Lumentum have both vertically integrated business models: they generate revenues at bare die, device, and module-level. II-VI also offers epiwafer products. Their combined bare die market share is around 30%.

Facing II-VI and Lumentum, Yole identifies major Chinese players like Hisense and Accelink. Both companies are in the global top five and are increasing step by step their share of the market. The two Chinese companies take advantage of the US-China trade tensions and the massive 5G transceiver deployment in Asia, explain Yole’s analysts in the InP report.

Sensing applications targeting the mass consumer and automotive markets are attracting new players. Yole has identified several players interested in entering this market:

- Vertically integrated InP players with the know-how and an already established structure, as they can easily switch to sensing applications as soon as the market becomes bigger. II-VI and Lumentum are part of this segment.

- GaAs players with foundry capabilities could leverage the existing GaAs tools to switch to similar InP processes. Yole sees for example, ams and Trumpf.

- Emerging foundries or companies already working on InP-based solutions.

According to Poshun Chiu, Technology & Market Analyst, Compound Semiconductors & Emerging Materials at Yole: “In the last category, we witnessed an increase in private investments and SPACs in the last year. These include, in Q4-2020, Luminar raised US$590 million and went public, then acquired OptoGration; in Q2-2021, Aeva went public with an initial valuation of US$1.7 billion; and in Q2-2021, Rockley Photonics announced its intention to go public at an initial valuation of US$1.2 billion with an Apple supported project for smartwatches”.

All year long, Yole Développement publishes an impressive collection of compound semiconductors & emerging substrates reports and monitors. InP technology & market report is part of these activities.

Experts realize various key presentations, organize key conferences and interview leading industrial companies all year long. Their aim is to deliver key results and technology and market trends and explain the major changes.

Make sure to be aware of the latest news coming from the industry and get an overview of our activities, including interviews with leading companies and more on i-Micronews. Stay tuned!

Extracted from:

- InP Wafer, Epiwafer and Device Market 2021: Photonics and RF Applications report, Yole Développement, 2021

ACRONYMS:

- InP: Indium Phosphide

- CAGR: Compound Annual Growth Rate

- DFB: Distributed Feedback Lasers

- EEL: Edge Emitting Laser

- LiDAR: Light Detection and Ranging

- OEM: Original Equipment Manufacturer

- GaAs: Gallium Arsenide