This market research report was originally published at Yole Développement’s website. It is reprinted here with the permission of Yole Développement.

“Many cameras” approach in mobile phones and automotive continues to drive the industry forward.

OUTLINE:

-

Market figures:

The COVID-19 pandemic combined with US-China trade tensions have marginally affected the continued growth in 2020.

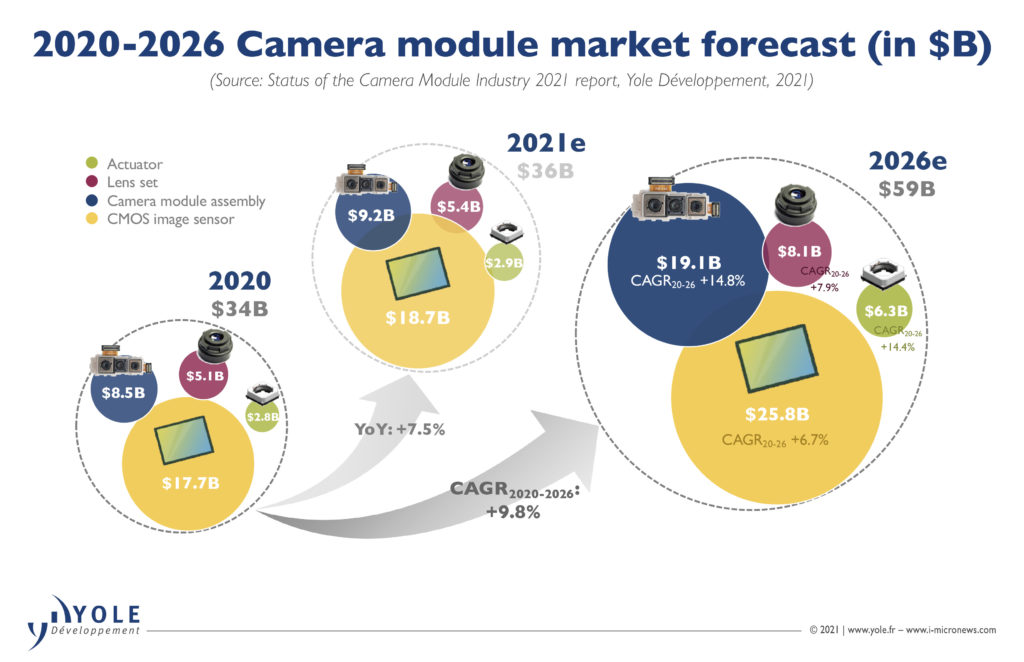

The global camera module revenue should reach US$59 billion in 2026.

Yole Développement (Yole) forecasts a 9.8% CAGR between 2020 and 2026.

The mobile CCM market segment is showing a 9.8% CAGR, against 14% for the automotive CCM market segment, which is becoming a significant sub-market.

The consumer market segment for CCM is far ahead with a 16% CAGR2020-2026.

In 2026, the CCM revenue should be shared between actuator (11%), lens set (about 14%), camera module assembly (32%), and CIS (about 43%).

-

Technology trends:

CIS, the most critical component in the CCM module, is still shrinking the pixel size and increasing the resolution.

Optic lens sets have introduced innovations such as using glass or free-form lenses or even liquid lenses, while OIS technology has moved from lens-shift to sensor-shift.

All the latest innovations help mobile cameras to move toward professional looking photography.

-

Supply chain:

From sub-components to manufacturing, there are numerous players in the CCM ecosystem.

Leading CCM players continue to vertically integrate upstream resources or expand their business.

LG Innotek occupies the 1st place in the CCM manufacturer rankings: the company grew rapidly in 2020 with large orders. Not far behind, Yole sees: Sunny Optical, O-Film, and Foxconn.

“During the outbreak of the pandemic in 2020, our private social life but also the entire economic life , including the CCM industry, were temporarily suspended, but swift action was taken, and the CCM industry quickly recovered.” asserts Richard Liu, Technology & Market Analyst, Imaging at Yole Développement (Yole). He adds: “The trade tension between China and the US led to Huawei being banned and not being able to purchase any key chips dedicated to the production of mobile phones. This created much motion within the ecosystem. However, the drive of the CCM industry as a whole was marginally affected in 2020”.

Yole and System Plus Consulting collaborated to produce in-depth analyses fully dedicated to the CCM industry and products. Both partners combined their technical expertise and market knowledge to get a deep understanding of the current challenges.

In this context, System Plus Consulting publishes a smart collection of reverse engineering studies throughout the year, focused on the comparison of CCM technologies and design choices. The latest volume is now available: Camera Module Comparison 2021 Vol. 3 – Samsung Galaxy S Evolution. This reverse engineering & costing analysis identifies Samsung’s Galaxy S camera design choices and points out the technical and cost evolution from the S7 to the S21 Ultra.

In parallel, the market research and strategy consulting company, Yole, releases today its annual imaging report: Status of the Camera Module Industry 2021. With this update, analysts offer a valuable update of the CCM ecosystem, along with a comprehensive description and study of the related markets and technologies involved. The 2021 edition delivers application ranges, technical market segmentation, market trends and forecasts, as well as key players by market.

The many cameras approach in mobile not only increases photography functions (such as macro, telephoto etc.) but also greatly improves the photographic effects. As a result, the multi-camera setups are observed in most smartphones, resulting in an increase in the number of mobile CCMs from 4.9 billion to 5.4 billion units from 2019 to 2020, a YoY growth of 10.4%.

From imaging to sensing, a 3D camera can be added in the front or rear (the front also includes optical fingerprint recognition), it positively affects the development direction of the many camera approach in mobile phones.

According to Pierre Cambou, MSc, MBA, Principal Analyst in the Photonics and Sensing Division at Yole: “The automotive CCM market started with a single rear camera and has now developed to ADAS combined with 360 surround-view cameras. Going from one to at least four or even more, this is characteristic of another “many cameras” trend. On the application side, ADAS is currently increasing the need for cameras. Innovations such as in-cabin cameras, as well as cameras to replace rearview mirrors are emerging. They will drive the next wave of the automotive CCM market.”.

In the consumer sector, products are becoming more intelligent – connected to everything – allowing vision to play a more significant role in applications such as robots and home surveillance systems. These will also increase the need for more camera modules. Yole expects the revenue from global camera modules to increase from US$34 billion in 2020 to US$59 billion in 2026, at a 9.8% CAGR.

From CCM sub-components to CCM manufacturing, there are numerous players in this industry. These include the upstream CMOS image sensor players, lens suppliers, and the CCM manufacturers themself, where the leading companies dominate the market.

“The image sensor is the most critical component in the module”, emphasizes Richard Liu. “Sony is the market leader in the industry’s supply chain, leading the market to increasing average pixel numbers and diminishing pixel sizes. Samsung, the number two CIS player, has done an excellent job in this area, taking the lead in launching products with a small pixel size(0.64um) and high resolution(200Mp)”.

In the No. 3 position, OmniVision is deeply engaged in the Chinese market, expanding it with its advantage of being a Chinese enterprise. As a result, it delivered excellent profits in 2020.

Peter Bonanno, Ph.D., Technology & Cost Analyst, Imaging, at System Plus Consulting adds: “As new technology becomes available, smartphone camera hardware has changed dramatically. One thing that hasn’t changed is that when it comes to flagship imaging modules, camera designers for the leading mobile OEMs continue to stick with CIS from Samsung, Sony and OmniVision”.

According to Yole’s analysis, these top 3 players combined already had around 74% market share.

Throughout the year, Yole Développement and System Plus Consulting publish an impressive collection of imaging-dedicated reports. Experts also deliver various keynote presentations, organize key conferences, and interview leading industrial companies. Their aim is to deliver key results, the technology and market trends, and explain the major changes.

Make sure to be aware of the latest news coming from the industry and get an overview of our activities on i-Micronews. Stay tuned!

Extracted from:

- Status of the Camera Module Industry 2021 report, Yole Développement, 2021

- Camera Module Comparison 2021 Vol. 3 – Samsung Galaxy S Evolution, System Plus Consulting, 2021

- Camera Module Comparison 2021 Vol. 2 – Apple iPhone Evolution, System Plus Consulting, 2021

- Camera Modules Comparison 2021 – Vol. 1, System Plus Consulting, 2021

Acronyms:

- CAGR: Compound Annual Growth Rate

- CCM: Compact (or CMOS) Camera Module

- CIS: CMOS Image Sensor

- OIS: Optical Image Stabilization

- YoY: Year-over-Year

- ADAS: Advanced Driver Assist Systems

- CMOS: Complementary Metal Oxide Semiconductor