This market research report was originally published at Yole Développement’s website. It is reprinted here with the permission of Yole Développement.

Consumer electronics & personal data processing MCUs are serviced by mature process nodes that are cost-effective, reliable, and inexpensive. Suppliers have a broad portfolio and large quantities of cost-effective and basic MCUs.

OUTLINE:

-

The global MCU market will reach US$26.4 billion in 2026.

-

GPUs and AI accelerators may be gathering all the media attention with promises of more TOPS and FLOPS, but AI is not just scaling up, it is scaling down…

-

The MCU market suffers as much from impacted OEM demand as automobile production struggles to get other high-performance components.

Lyon, France, March 3d 2022 – The market research and strategy consulting company, Yole Développement (Yole), has followed the microcontroller industry for some time. Yole’s analysts combine their technical expertise and knowledge to deliver a comprehensive overview of MCU technologies and markets in a dedicated quarterly market monitor, Microcontroller Quarterly Market Monitor, Q4 2021 edition. The aim of Yole’s MCU Monitor is to provide in-depth coverage of the rapidly changing market dynamics and the leading players’ status and strategy. The overall market size is derived from both “top-down” and “bottom-up” analyses. The “top-down” analysis is based on the quarterly revenue reported by MCU suppliers. The resulting analysis provides a base year 2020, reported data through 2021, revenue, units and ASP, quarterly estimates and 5-year annual forecast, regional, class and market organized data, supplier rankings and profiles, manufacturing data…

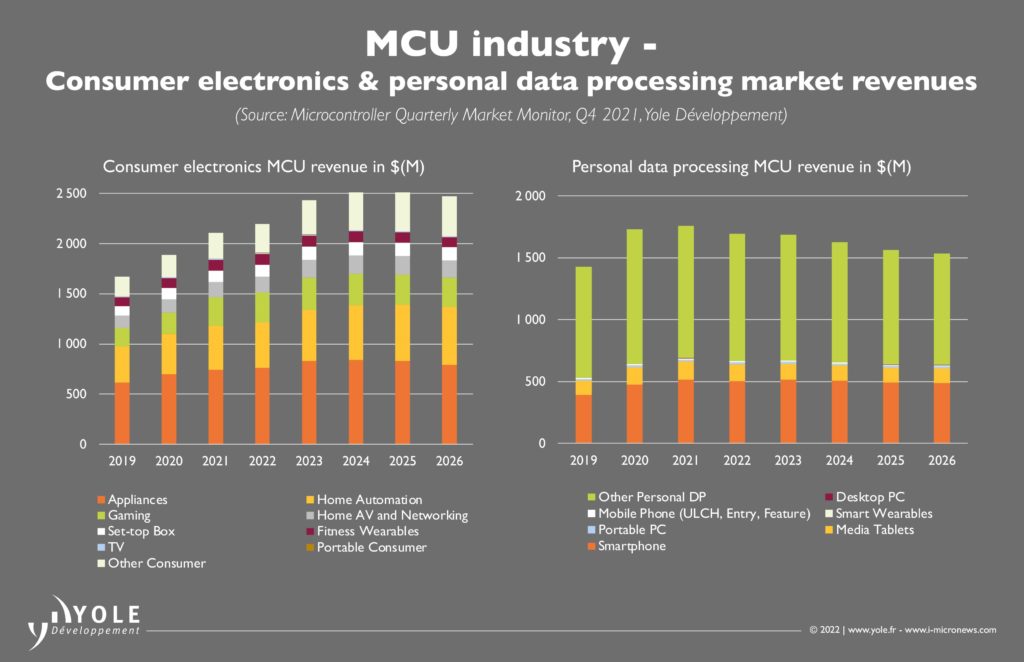

For Tom Hackenberg, Principal Analyst, Computing & Software at Yole: “Despite both consumer electronics and personal data processing being consumer products, the supply chain and design priorities for these two markets are very different and deserve individual analysis.”

Consumer electronics is an extremely diverse group of applications and is targeted by the multimarket MCU Class. Because of the high number of battery-operated devices and accessories, consumer designs depend more heavily on 4/8/16-bit MCUs. Consumer electronics designs are also very price-sensitive since consumers are typically more concerned with out-of-pocket expense at the time of purchase than the total cost of ownership or long-term reliability. Because of this, the product time-to-market and cost of components are major factors. The MCUs used in Consumer electronics are serviced by mature process nodes that are cost-effective, reliable, and inexpensive.

The personal data processing market focuses on cutting-edge compute performance. These devices are also frequently a repository of sensitive user data, which means storage and advanced security strategies. Network connectivity (either directly or tethered) is not only convenient but also an essential design feature for the device’s functionality. Graphics and complex user interfaces are also required features. Because of the user-experience and IoT scope, the companies or company divisions that build personal data processing equipment are separate from other consumer electronics. While time-to-market and volume efficiency are still common priorities to both markets, performance and security replace cost and diversity as priority design strategies.

The microcontroller market competitive landscape has evolved through numerous acquisitions. It is highly significant that the top five microcontroller suppliers, collectively accounting for a substantial share of the mergers and acquisitions over the last decade, now represent over 80% of the overall MCU market. All of these are IDMs. However, the market still includes numerous designers. At least 40 suppliers are each estimated to generate over $50 million in annual revenue. Since many microcontrollers are manufactured on mature processes, the market can sustain a large number. Still, for those vying for cutting-edge manufacturing technologies, only a few can produce at volumes that can sustain the large non-recurring expenditures of near cutting-edge manufacturing.

This press announcement is fully dedicated to the Microcontroller Quarterly Market Monitor Q4 2021.

Related products:

- Processor Quarterly Market Monitor

- Neuromorphic Computing and Sensing 2021

- Artificial Intelligence Computing for Automotive 2020

Related article:

- MCU prices to remain higher for several years – Microcontroler (MCU) Quarterly Market Monitor, written by Tom Hackenberg.

Acronyms:

- IoT: Internet of Things

- IDM : Integrated Design Manufacturers

- MCU: Microcontroller

- GPU: Graphics Processing Unit

- AI: Artificial Intelligence

- OEM: Original Equipment Manufacturer