This market research report was originally published at Yole Développement’s website. It is reprinted here with the permission of Yole Développement.

OUTLINE:

-

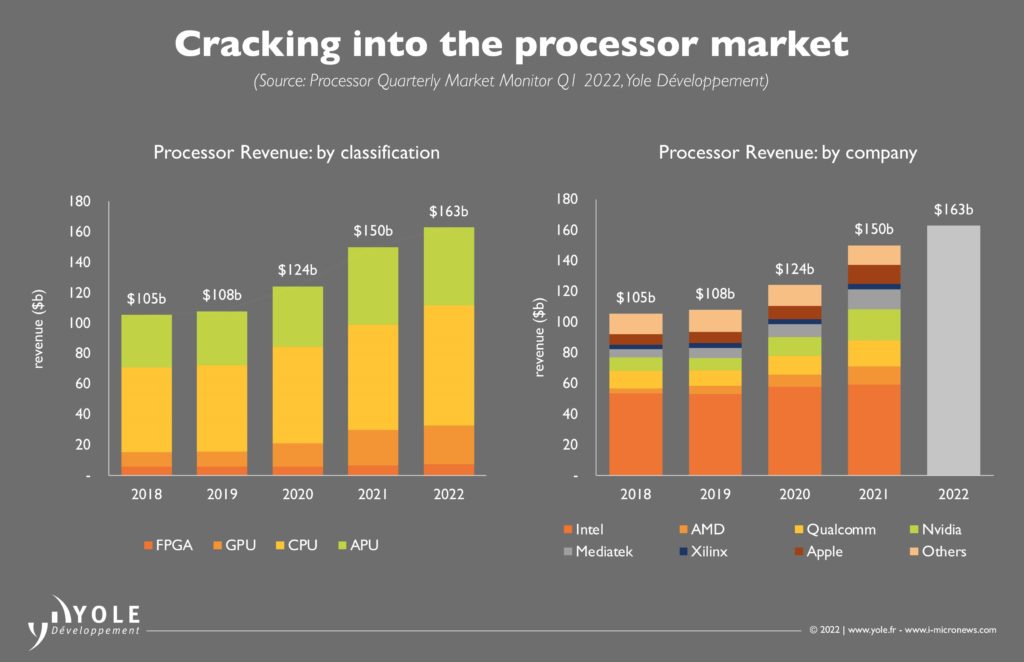

7 companies generate more than 90% of the overall designer revenue.

-

The use of chiplets or other multi-chip schemes is increasing in CPUs.

-

2021 saw new records in foundry services revenue.

Lyon, France, April 26 2022 – The market research and strategy consulting company Yole Développement (Yole) has developed core computing and software expertise with a dedicated team of technology and market experts. All year long, the computing and software team delivers a comprehensive understanding of the processor industry, combining technical trends and market evolution. The company publishes significant analyses, including technology and market reports, quarterly market monitors, and teardowns throughout the year.

Today, Yole releases its Processor Quarterly Market Monitor, Q1 2022 update. This product is one of a wide collection of monitors that cover the main dynamic markets of the semiconductor industry, including CIS, Compound Semiconductor, Advanced Packaging Memory (DRAM & NAND), and MCU.

The Processor Quarterly Market Monitor follows the challenges and opportunities of the processor industry in detail. Yole provides accurate market data and trends every quarterly. The company also delivers a valuable understanding of the value chain, the competitive landscape, and a comprehensive overview of the strategies of the leading companies.

John Lorenz, Senior Technology & Market Analyst, Computing & Software at Yole, writes: “The current semiconductor growth trend does not resemble those that came before. Taking stock of the past cycles, at Yole we see a common theme: a certain application finds its place in society, and the OEMs and major semiconductor companies race to fill the massive, growing demand. The winners are those OEMs that offer the right product with the right specifications at the right price, and the chip vendors with design wins reap the benefits”.

See Intel during the PC boom of the 1990s or Qualcomm during the smartphone era of 2010-2015.

Today, instead of a key end system (like a PC or smartphone), we have a key technology, AI , and many possible implementations that carry huge potential, comments John Lorenz from Yole. Some AI implementations will follow familiar market characteristics; AI in data centers, for example, has found a formidable acceleration engine in the general-purpose GPU, and those players who build GPUs certainly benefit. But AI has the potential to change so much more in all facets of life, whether in automotive and mobility, or industrial and retail, in medical… really any application where contextual value can be added to sensed data is a candidate for deploying AI technology.

Some players are well-aligned to this dynamic (see Nvidia’s data center growth), but others like Intel have yet to really cash in on the new trend. It is worth looking at how Intel has evolved in just the last four years. Based on a comparison between the Intel of today against the Intel of 2018, Yole’s analysts see a company with similar revenue actualization in the core compute businesses centered on computing in PC and data centers, but the strategic positioning of these two companies is quite different. The Intel of the late 20-teens looked to capitalize on the growing data center market as the dominant provider of MPUs. At the time, Intel still carried enterprise storage ambitions with the NVM business dominated by NAND, as part of a strategy to provide more of the data center hardware… Full article on i-Micronews.

Acronyms:

- CPU: Central Processing Unit

- CIS: CMOS Image Sensor

- MCU: Microcontroller Unit

- OEM: Original Equipment Manufacturer

- AI: Artificial Intelligence