For more information, visit https://www.berginsight.com/the-video-telematics-market.

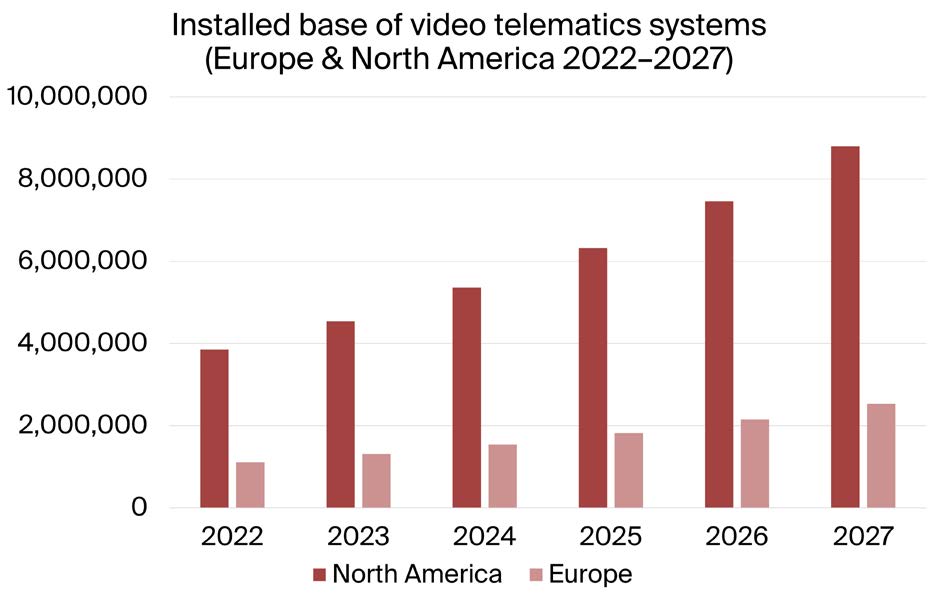

The integration of cameras to enable various video-based solutions in commercial vehicle environments is one of the most apparent trends in the fleet telematics sector today. Berg Insight’s definition of video telematics includes a broad range of camera-based solutions deployed in commercial vehicle fleets either as standalone applications or as an additional feature set of conventional fleet telematics. Berg Insight estimates that the installed base of active video telematics systems in North America reached almost 3.9 million units in 2022. Growing at a compound annual growth rate (CAGR) of 18.0 percent, the active installed base is forecasted to reach 8.8 million units in North America by 2027. In Europe, the installed base of active video telematics systems reached over 1.1 million units in 2022. The active installed base is forecasted to grow at a CAGR of 17.9 percent to reach 2.5 million video telematics systems in Europe by 2027.

The video telematics market is served by many companies ranging from specialists focused specifically on video telematics solutions for various commercial vehicles, to general fleet telematics players which have introduced video offerings, and hardware-focused suppliers offering mobile digital video recorders (DVRs) and vehicle cameras used for video telematics. Berg Insight ranks Streamax, Lytx and Samsara as the leading video telematics players in their respective categories. Streamax is the leading hardware provider, having over 2.4 million mobile DVRs installed in vehicles globally to date, and the company also offers software dashboards which are widely used together with its devices. Lytx in turn has the largest number of video telematics subscriptions, while Samsara stands out among the general fleet telematics players with a significant number of camera units deployed across its subscriber base. Additional sizeable players include the new channel-focused brand Sensata INSIGHTS (including the acquired video telematics company SmartWitness), the fleet management player Motive (formerly KeepTruckin), the hardware-focused video telematics company Howen, and the fleet management provider Solera Fleet Solutions (which acquired the commercial vehicle telematics pioneer Omnitracs including the video safety specialist SmartDrive). The remaining top-10 players are Netradyne, Nauto and VisionTrack which all have a primary focus on camera-based solutions specifically. Other noteworthy players competing in the video telematics space include video-focused solution providers such as Bendix (SafetyDirect by Bendix CVS), Idrive, SureCam, LightMetrics, Waylens, Seeing Machines and CameraMatics; fleet telematics players including Trimble, Matrix iQ, MiX Telematics, Forward Thinking Systems, Radius Telematics, ISAAC Instruments, Azuga, Microlise, Trakm8 and AddSecure Smart Transport; as well as the hardware-focused supplier Pittasoft (BlackVue), which have all reached estimated installed bases in the tens of thousands.