BOSTON, May 10, 2023 /PRNewswire/ — Artificial Intelligence has come a long way since the success of DeepMind over Go world champion Lee Sedol in 2016; the world is beginning to change according to the new possibilities afforded by AI. From the robust predictive abilities of OpenAI’s ChatGPT – where the AI chatbot can be used for all sorts of purposes, from creating scripts (including malware) to writing academic essays – to AI image generators that are so good that they can win Sony world photography awards, the complexity and capabilities of AI algorithms are growing at a startlingly fast pace. Hardware is hardly divorced from this. As machine learning workloads become more complex and more compute-hungry, so must hardware scale appropriately to ensure cost-efficiency for end users without stalling progress in the software domain. Hardware and software are tightly linked, and it is the matter of control and ownership of AI hardware that is emphasized in IDTechEx’s latest report, ‘AI Chips 2023-2033′.

The Price of Failure

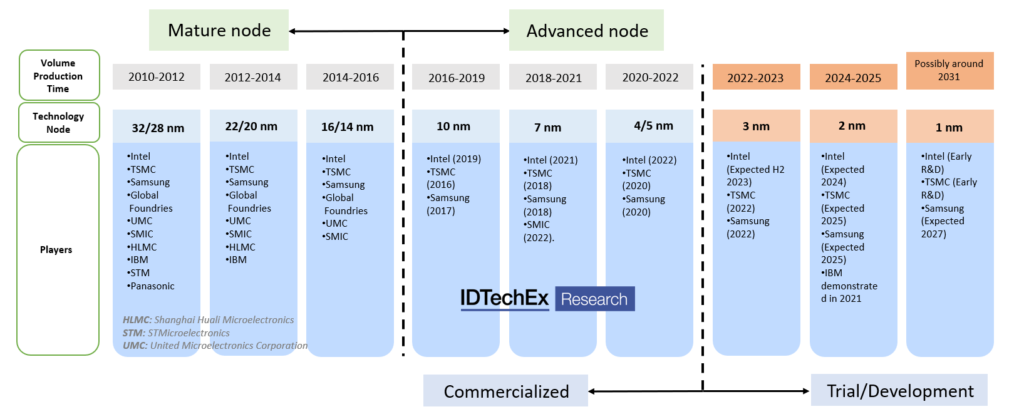

2016 may have been the year that the world first took notice of the reality of AI, but IDTechEx believes that 2020 will be the year that is remembered as a turning point in technology initiatives across the globe. Chips for AI training – where training refers to providing AI algorithms with large datasets, such that the algorithm can adjust its weights in order to better fit with the provided data – are typically at the most leading-edge nodes, given how computationally intensive the training stage of implementing an AI algorithm is. Intel, Samsung and TSMC are the only companies that can produce 5 nm node chips. Of these, TSMC is currently the only company that is having any real success with securing orders for 3 nm chips. TSMC is a Taiwanese company, Samsung South Korean. TSMC has a global market share for semiconductor production that is currently hovering at around 60%. For the more advanced nodes, this is closer to 90%. Of TSMC’s six 12-inch fabs and six 8-inch fabs, only two are in China and one is in the USA. The rest are in Taiwan. Therefore, the semiconductor manufacture part of the global supply chain is heavily concentrated in the APAC region, principally Taiwan.

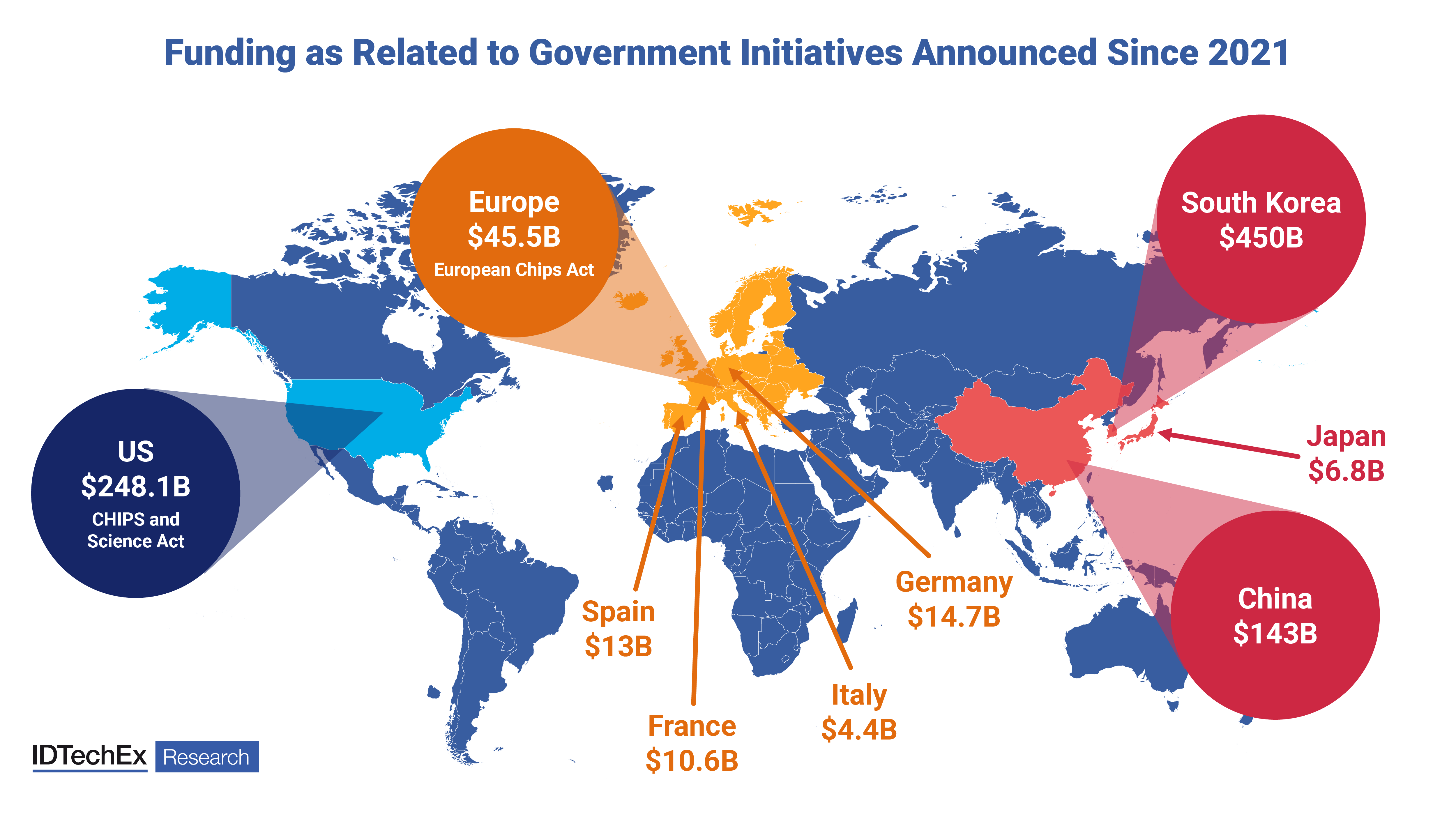

Such a concentration comes with a great deal of risk should this part of the supply chain be threatened in some way. This is precisely what occurred in 2020 when a number of complementing factors (such as the COVID-19 pandemic, the rise of data mining, a Taiwanese drought, fabrication facility fire outbreaks, and neon procurement difficulties due to the Russia-Ukraine war) led to a global chip shortage, where demand for semiconductor chips exceeded supply. Since then, the largest stakeholders (excluding Taiwan) in the semiconductor value chain (the US, the EU, South Korea, Japan, and China) have sought to reduce their exposure to a manufacturing deficit should another set of circumstances arise that results in an even more exacerbated chip shortage.

The Prize

But this is not the only reason that national and regional government initiatives have been put in place to incentivize semiconductor manufacturing companies to expand operations or build new facilities. The manufacture of advanced semiconductor chips fuels national/regional AI capabilities. These capabilities, in natural language processing (understanding of textual data, not just from a linguistic perspective but also a contextual one), speech recognition (being able to decipher a spoken language and convert it to text in the same language, or convert to another language), recommendation (being able to send personalized adverts/suggestions to consumers based on their interactions with service items), reinforcement learning (being able to make predictions based on observations/exploration, such as is used when training agents to play a game), object detection, and image classification (being able to distinguish objects from an environment, and decide on what that object is), are so significant to the efficacy of certain products (such as autonomous vehicles and industrial robots) and to models of national governance and security, that the development of AI hardware and software should be at the top of the agenda for any government body that wishes to be at the technological forefront.

Report Coverage

IDTechEx forecasts that the global AI chips market will grow to US$257.6 billion by 2033. How this pie is sliced will largely depend on how effective funding initiatives are. IDTechEx’s report breaks down each major national and regional funding initiative related to semiconductor manufacture, giving analysis pertaining to where funding is coming from, how this is to be dispensed, and the relative effectiveness of each governing body’s initiatives. Geopolitical background is given, difficulties and opportunities presented, and each region’s use and expertise with AI clearly detailed. In addition, the major private investments made and announced since 2021 with regard to semiconductor manufacture are surveyed and contextualized within overarching funding initiatives.

More generally, the report covers the global AI Chips market across eight industry verticals, with 10-year granular forecasts in seven different categories (such as by geography, by chip architecture, and by application). In addition to the revenue forecasts for AI chips, costs at each stage of the supply chain (design, manufacture, assembly, test & packaging, and operation) are quantified for a leading-edge AI chip. Rigorous calculations are provided, along with a customizable template for customer use and analyses of comparative costs between leading and trailing edge node chips.

IDTechEx’s latest report, ‘AI Chips 2023-2033‘, answers the major questions, challenges and opportunities faced by the AI chip value chain. For further understanding of the markets, players, technologies, opportunities, and challenges, please refer to this report.

To find out more, including downloadable sample pages, please visit www.IDTechEx.com/AIChips.

Upcoming Free-to-Attend Webinar

How AI Is Shaking up the Global Semiconductor Supply Chain

Leo Charlton, Technology Analyst at IDTechEx and author of this article, will be presenting a free-to-attend webinar on Wednesday 7 June 2023 – How AI Is Shaking up the Global Semiconductor Supply Chain.

Contents that will be covered in this webinar include:

- AI capabilities and why these matter

- The link between AI and semiconductor manufacture

- Reasons for government funding initiatives into shoring up domestic semiconductor supply chain capabilities

- Outlook, both with regards to the effectiveness of these campaigns, as well as the global semiconductor supply chain and AI chips until 2033

Click here to find out more and register your place on one of our three sessions. If you are unable to make the date, please do register for one of the sessions anyway to receive the links to the on-demand recording and slides as soon as they are available.

About IDTechEx

IDTechEx guides your strategic business decisions through its Research, Subscription and Consultancy products, helping you profit from emerging technologies. For more information, contact [email protected] or visit www.IDTechEx.com.