Since the introduction of Artificial Intelligence to the data center, AI has been loath to leave it. With large tracts of floorspace dedicated to servers comprising leading-edge chips that can handle the computational demands for training the latest in AI models, as well as inference via end-user connections to the cloud, data centers are the ideal environment for facilitating much of what AI has to offer. And yet, over the past decade, AI has pushed steadily at the boundaries of the cloud computing environment in a bid to infiltrate the realm beyond.

The edge of the network, where users have immediate interaction with devices that do not necessarily rely on the cloud for computation, has been touted as something of the promised land for AI, where inclusion of accurate and somewhat autonomous AI – where devices are linked via Wi-Fi connectivity – would enable a true Internet of Things. This has been the expectation for the best part of the decade, with the great Edge AI takeover still forthcoming. Instead, AI has slowly trickled into certain household devices and consumer electronics goods, with other applications yet to realize the full impact that AI has promised.

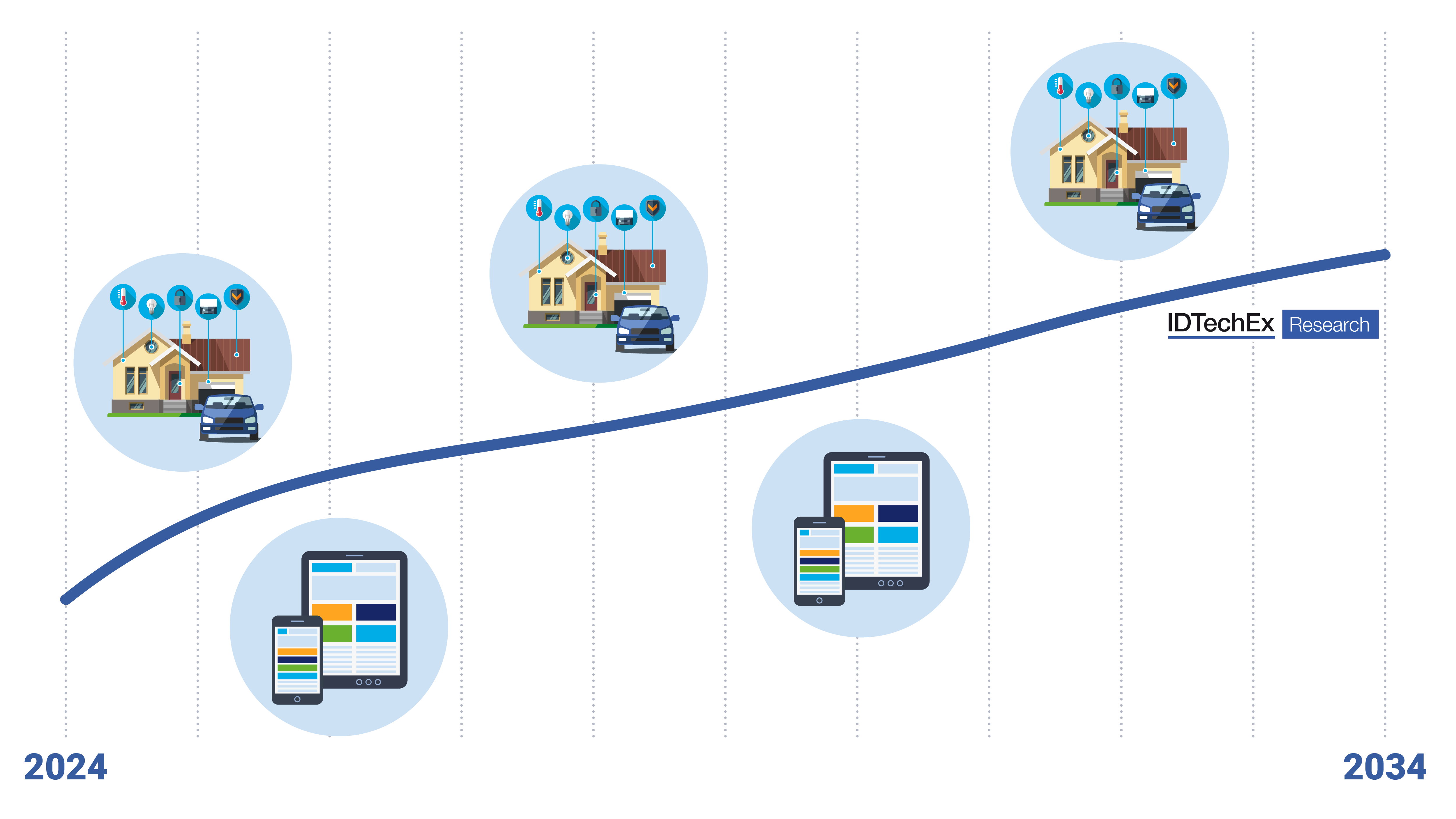

In a recently released IDTechEx report, “AI Chips for Edge Applications 2024-2034: Artificial Intelligence at the Edge“, market research company IDTechEx notes that the production rollout of technology being developed by a number of AI chip start-ups targeting edge applications will see AI at the edge continue to grow substantially over the next ten years…albeit not with the type of exponential growth that a ‘boom’ would suggest.

Revenue growth of AI chips used for edge applications does not progress at a constant rate, due to the competing maturation of certain markets (such as for smartphones) against the adoption of AI in others (such as automotive).

AI in Smartphones Headed Towards Saturation; Automotive Just Getting Started

The reasons behind the unconventional growth are multiple, but they boil down to falling under two categories: the first being the saturation and stop-start nature of certain markets that have already employed AI architectures in their incumbent chipsets, and the second being where rigorous testing is necessary prior to high volume rollout of AI hardware. Under the first category, a key example is the smartphone market, which has already begun to saturate. However, premiumization of smartphones continues (where the percentage share of total smartphones sold given over to premium smartphones is, year-on-year, increasing), where AI revenue increases as more premium smartphones are sold given that these smartphones incorporate AI coprocessing in their chipsets, it is expected that this will itself begin to saturate over the next ten years.

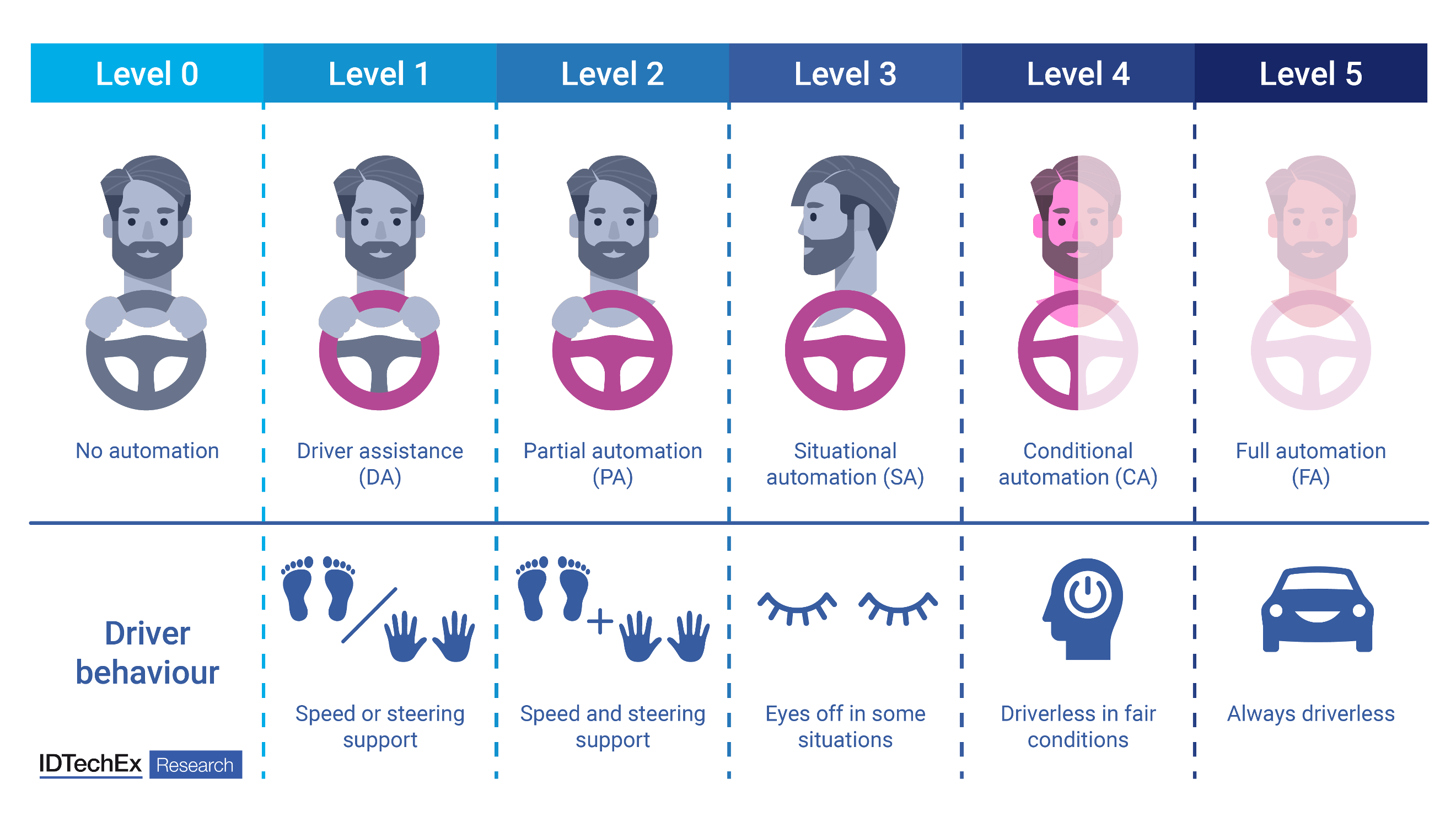

Under the second category, flagship automotive-grade System-on-Chips (SoCs) for Advanced Driver-Assistance Systems (ADAS) from the likes of Renesas, Qualcomm, and Mobileye are all planned to hit automotive manufacturers’ 2024/25 production lines. These systems allow for a minimum driving automation level (officially known as SAE level) 3, allowing for situational automation where driver input is not necessary in certain situations. Further scaling of technology after rigorous testing will allow for further checkpoints in driving automation to be reached, with the adoption of increasing automation to occur in stages.

The SAE levels of driving automation.

Only a Matter of Time Now

Though the types of models that are employed at the edge will be, in the main, much simpler than those handled within data centers, due to the power constraints of edge devices, it is only a matter of time before even the simplest of AI functions – such as hands-free activation and actioning – comes as an added feature to a range of devices, particularly within the home. IDTechEx have identified the Smart Home as one of the main beneficiaries of AI technology, with the potential to transform how we live and interact with our immediate surroundings.

IDTechEx Report Coverage

IDTechEx forecasts that the global AI chips market for edge devices will grow to US$22.0 billion by 2034. IDTechEx’s report gives analysis pertaining to the key drivers for revenue growth in edge AI chips over the forecast period, with deployment within the key industry verticals – consumer electronics, industrial automation, and automotive – reviewed. More generally, the report covers the global AI Chips market across eight industry verticals, with 10-year granular forecasts in six different categories (such as by geography, by chip architecture, and by application).

IDTechEx’s brand new report, “AI Chips for Edge Applications 2024-2034: Artificial Intelligence at the Edge”, answers the major questions, challenges and opportunities faced by the edge AI chip value chain. The report offers an understanding of the markets, players, technologies, opportunities, and challenges. For more information on the report, including downloadable sample pages, please visit www.IDTechEx.com/EdgeAI, or for the full portfolio of AI research available from IDTechEx, please visit www.IDTechEx.com/Research/AI.

About IDTechEx

IDTechEx guides your strategic business decisions through its Research, Subscription and Consultancy products, helping you profit from emerging technologies. For more information, contact [email protected] or visit www.IDTechEx.com.

Leo Charlton

Technology Analyst, IDTechEx