For thousands of years, people have relied on and continue to rely on their vision to assess their surroundings. They evaluate objects and apply pre-conceived hypotheses based on what they see, and they do this daily. Eyes can be deceived, nonetheless, and for all people know, a jar of sugar could easily pass as a jar of table salt. In reality, taste is another main difference between both; fortunately, all of the senses are present to help navigate daily routines.

Vision is limited to a very narrow range of wavelengths, from various shades of blue to red, i.e., approximately 380-700 nm. Anything shorter approaches the ultraviolet region and over-transitions to the infrared area. Humans naturally have a tendency to judge what they can see. Still, the electromagnetic spectrum is significantly larger than what people are capable of visualizing, and what may appear invisible quickly becomes visible when looking at it from another frequency.

IDTechEx’s new report, “Emerging Image Sensor Technologies 2024-2034: Applications and Markets“, covers different imaging technologies and the ability to enhance vision to different regions in the electromagnetic spectrum.

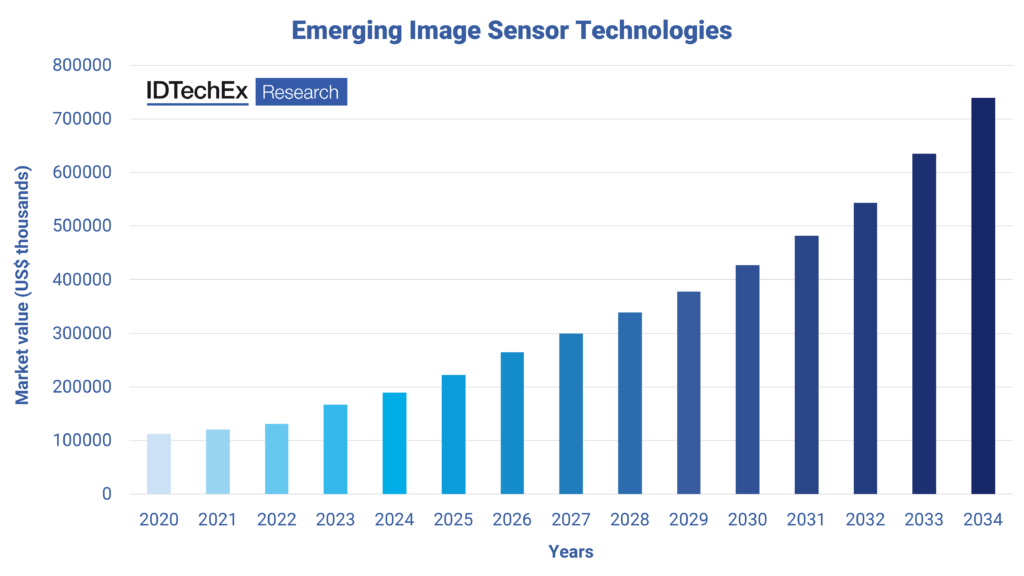

Several areas benefit from these imaging technologies, including healthcare, biometrics, autonomous driving, agriculture, chemical sensing, and food inspection, among others. IDTechEx expects the market will grow significantly in the coming decade, reaching US$739 million by 2034.

This is, however, a more conservative figure because the cost of these sensors remains high with indium gallium arsenide (InGaAs) short-wave infrared (SWIR) sensors, for instance, costing approximately US$20,000 per sensor and despite expectations of this cost decreasing over time, using these in the consumer electronics sector would require the cost of these sensors to decrease significantly, to values approximating US$10-100. There are, however, technologies such as quantum dots-on-CMOS (QD-on-CMOS) that could deliver on this extended infrared (IR) sensitivity at a lower cost. If implemented in this consumer electronics sector, this market could see a 25X increase in value with respect to the conservative value quoted earlier.

As the name suggests, SWIR sensors allow the visualization of objects in the near infrared region approaching the mid-infrared regions, i.e., from 750 to 2000nm. Several industries benefit from this technology; however, the costs associated with these sensors, particularly the use of InGaAs sensors are prohibitive, especially in applications that would require scalability, autonomous driving, and industrial inspections being two clear areas where the decrease in cost would result in the rapid further adoption of SWIR technology.

As a result, alternatives to InGaAs have been gaining traction, most notably extended silicon, germanium, and hybrid approaches, such as organic photodiodes-on-CMOS (OPD-on-CMOS) or QD-on-CMOS. All these approaches have varying wavelength sensitivities; however, despite their potential, they still underperform compared to the incumbent InGaAs technology. The latter is more mature and performs well in the SWIR wavelength range, although QD-on-CMOS is expected to surpass this technology both in terms of performance and, more importantly, cost, i.e., cheaper to manufacture.

These developments are awaited with many expectations from numerous industries, from autonomous driving to agriculture and industrial product inspections. The use of more affordable SWIR imaging can help accelerate the impact of these technologies. In vehicle autonomy and Advanced driver-assistance system (ADAS), it is essential in helping recognize objects in less visible conditions. Unlike visible light-sensitive cameras, SWIR cameras are very effective in fog/mist/dust/dark conditions and can help recognize objects under varied ambient scenarios. ADAS systems require multiple imaging sensors in the future to draw a better picture of a vehicle’s surroundings. Therefore, these units’ costs must drop significantly to make them cost-effective for automotive original equipment manufacturers (OEMs).

Agriculture is another industry that is gradually seeing the benefits of this technology and will yet see further progress as SWIR sensors mature and the cost decreases. The details seen using an infrared sensor can determine whether the crops are suitable to pick or the soil is suitable to grow these crops, for instance.

Industrial product inspection can detect intrusion and misplaced objects within a product. It can be used as a plastic sorting mechanism in factories, for example. Different plastic materials have different chemical compositions, and these have varied responses to a wide range of infrared wavelengths in the spectrum, i.e., they are either absorbed or reflected. Depending on their reactions, it is possible to sort these plastics and match them.

Nevertheless, as previously mentioned, the most dominant SWIR technology is InGaAs, and the cost of these devices is prohibitive for many applications. While it does perform well and has heightened sensitivity for a wide range of wavelengths, its low yields and limited pixel resolution due to the hybridization with silicon hinder its potential to reach a larger market size.

However, the rise of quantum dots on CMOS that can integrate with existing silicon-based readout integrated circuits (ROIC) and exhibit high sensitivity to a wide range of infrared wavelengths could be a path towards this technology having an even greater reach to many more industries.

For more details on the emerging image sensor market and the future of autonomous driving, please see the IDTechEx market reports, “Emerging Image Sensor Technologies 2024-2034: Applications and Markets” and “Autonomous Cars, Robotaxis and Sensors 2024-2044“.

Dr Miguel El Guendy

Technology Analyst, IDTechEx

About IDTechEx

IDTechEx guides your strategic business decisions through its Research, Subscription and Consultancy products, helping you profit from emerging technologies. For more information, contact [email protected] or visit www.IDTechEx.com.