This market research report was originally published at the Yole Group’s website. It is reprinted here with the permission of the Yole Group.

$1B market is expected for robotic vehicle processors in 2034

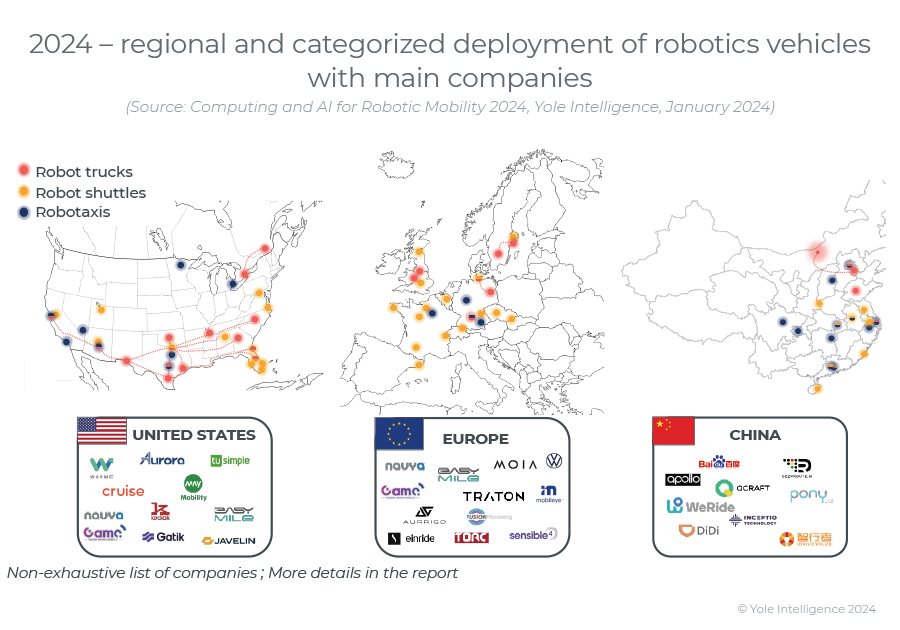

The global market for robotic vehicles is led by the United States and China, with Europe following closely. Robotaxi services are thriving in China and the U.S., with Baidu-Apollo leading with services in twelve cities. In Europe, the market is still in its early stages due to regulatory challenges and the complexity of European roads. On one hand, robot shuttles represent a niche within the industry, with the potential for growth expected around 2027/2028. They could provide a solution for public transport if operating costs are reduced and profitability increases. Robot trucks, on the other hand, hold enormous potential for economic disruption and value creation due to the high volume of goods transported. Punctuality, safety, and productivity are crucial in this market, as any accident can be extremely dangerous.Combined, robotaxi, robot shuttle, and robot truck production is projected to grow from around 8,000 units in 2023 to 140,000 in 2029 and about 1 million in 2034, representing a volume CAGR23-34 of 56%. The processor market is set to expand significantly, reaching $1 billion in revenue by 2034, driven by the growing number of robotic vehicles.

United States and China lead in robotaxis, while Europe follows with robot shuttles

The global landscape for robotic vehicles is divided into three main regions: the United States, China, and Europe. The U.S. is actively testing autonomous vehicles, with robotaxi services available in a few cities, and robot trucks connecting the East Coast to the West Coast are advancing rapidly. China has emerged as a leader in autonomous technology, with Baidu-Apollo taking the lead in robotaxi and shuttle services, followed by other dynamic companies such as WeRide and Pony.ai. Europe is also active, mainly with robot shuttle companies and tests. The Middle East, particularly the UAE and KSA, is actively engaging in robotic mobility projects through partnerships with European, Chinese, and American companies. Robotic vehicle companies in the autonomous vehicle industry are initially concentrating on their core segments to control costs and increase scalability. In the past nine years, almost $42.5 billion has been invested in robotaxis, robot shuttles, and robot trucks globally, with robotaxi companies leading in investments.

The growing robotaxi market will be shared between automotive and custom-designed processors

Robotic vehicle processors, crucial for achieving autonomy, require high computing power for real-time decision-making. Server/PC-grade processors were initially used due to their ample computing capabilities. However, as the automotive processor market evolved, the processors designed for ADAS/AD functions have become more suitable for robotic vehicles, and they are both cheaper and more energy-efficient.Nvidia was an early market entrant, introducing high-performance processors with the Parker architecture in 2016, and its processors are now prevalent in many robotic vehicles. But the competition is intensifying as ADAS/AD processors are being developed, and companies such as Mobileye, Qualcomm, and Huawei are gaining traction. Several startups, including China-based Horizon Robotic and Black Sesame, offer potential solutions for Chinese companies seeking secure domestic supply chains.On the architecture side, several solutions are being developed. As an alternative to a fully centralized architecture based on a single processor, Mobileye has developed a scalable processor family that reduces development costs and offers a unified solution that can be adapted to their customers’ needs. At the same time, a growing trend among robotic industry leaders is the in-house development of custom processors to meet specific needs.