Woodside Capital Partners (WCP) is pleased to share its Computer Vision and Vision AI Market Report Q3 2024, authored by Managing Partner Rudy Burger, and Associate Akhilesh Shridar.

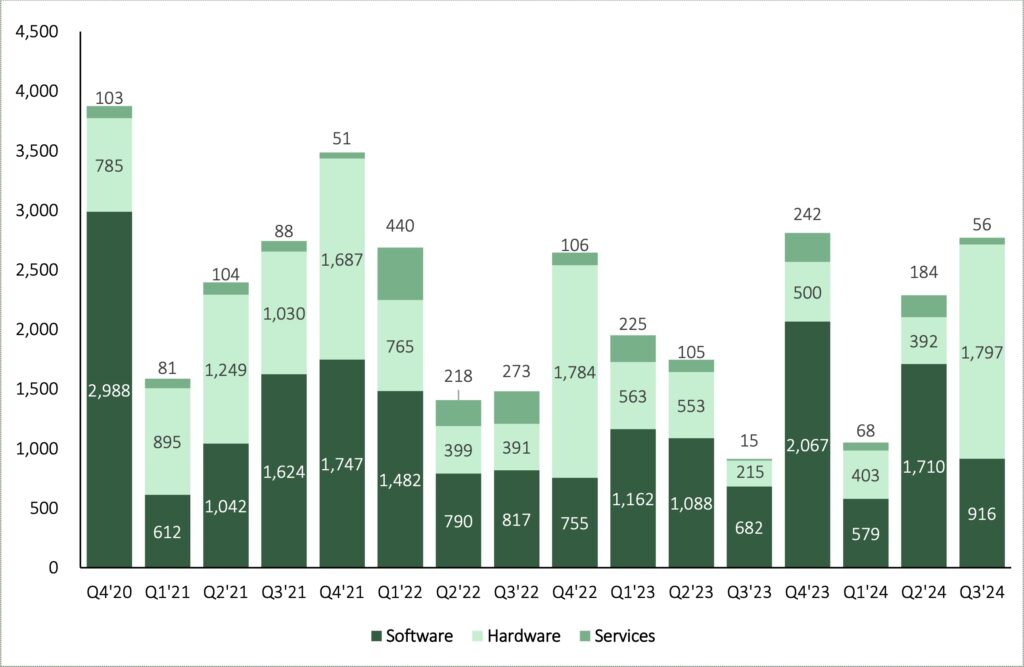

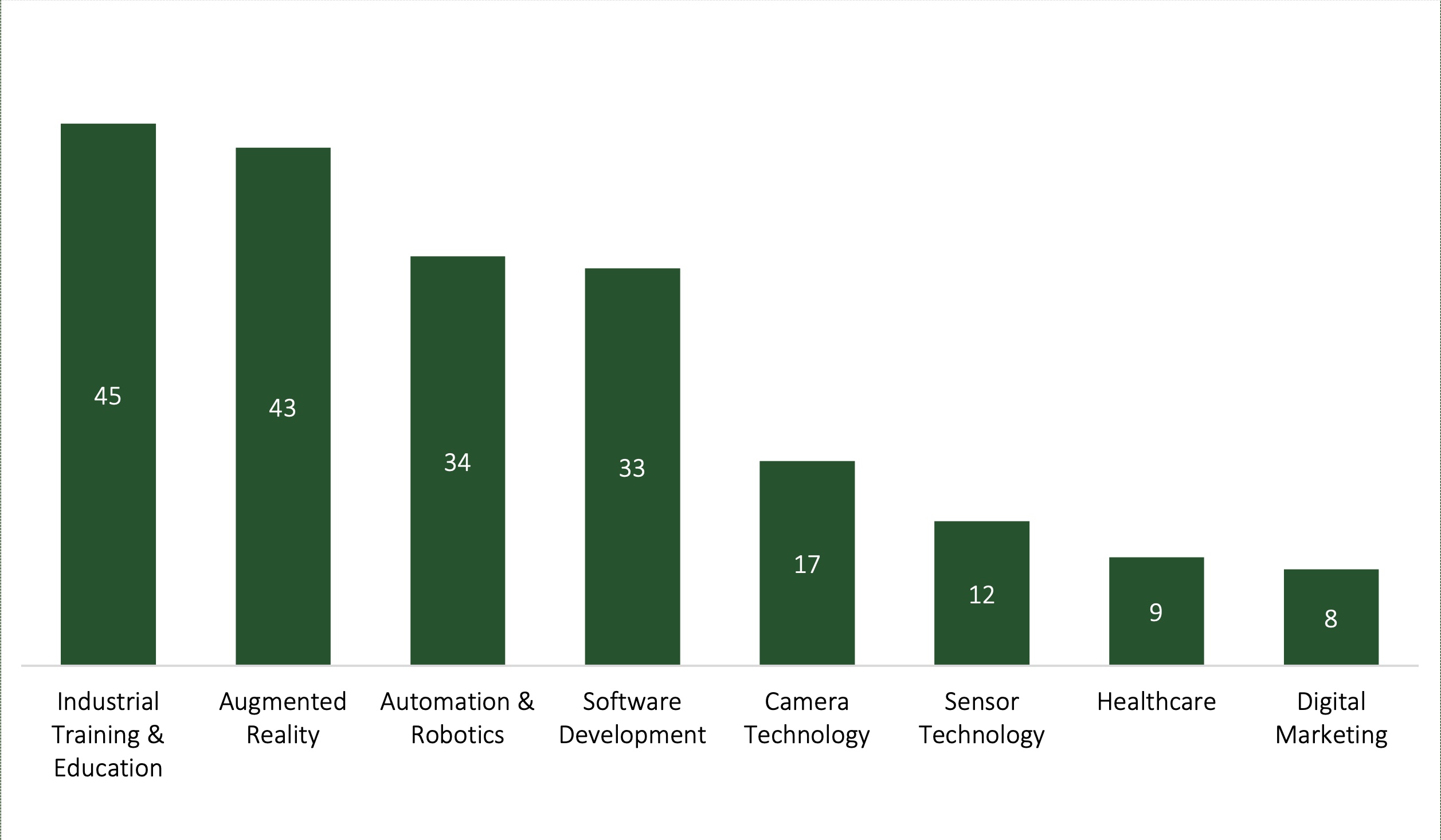

Hardware startups generally take longer to get a product to market and require more investment than software companies. Hardware has a more complicated distribution and sales structure than software and hardware startups have a lower survival rate than software startups. In the U.S., only 24% of hardware startups raise second-round funding, and 97% die or become zombie companies after this first round. For these reasons, venture capital has traditionally favored software over hardware startups. However, as we show in this quarterly computer vision snapshot, there appears to be a resurgence in patient capital – VCs have a renewed interest in investing in hardware companies, as shown by Q3 investment data.

Hardware companies often have higher barriers to entry for competitors. They are also getting a boost from renewed interest (and government funding) in re-shoring manufacturing domestically. Hardware companies are also at the forefront of breakthrough innovations based on deep science and engineering (so-called “deep-tech”). Computer vision has been a strong driver for new innovative hardware companies – including companies developing new sensors, optics, illuminators, and processors.

However, we expect the debate of hardware versus software to become increasingly irrelevant. Successful companies will increasingly be those that seamlessly integrate the two.

Investment in Computer Vision Swings Towards Hardware in Q3 2024 ($M)

Investment in Computer Vision Swings Towards Hardware in Q3 2024 ($M)

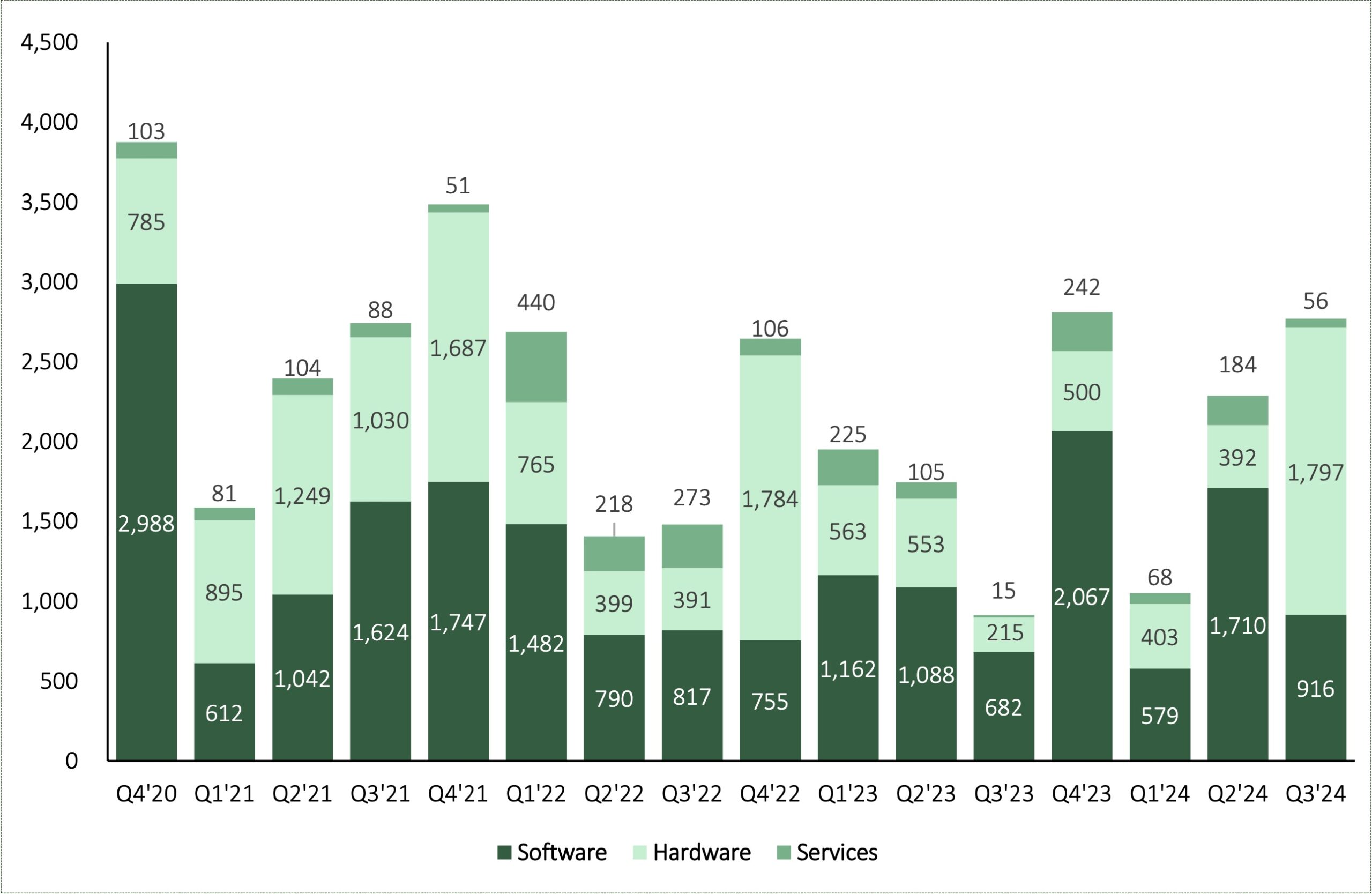

Computer Vision & Vision AI Financing Volume Steadies below 12-month Trailing Average

Computer Vision & Vision AI Financing Volume Steadies below 12-month Trailing Average

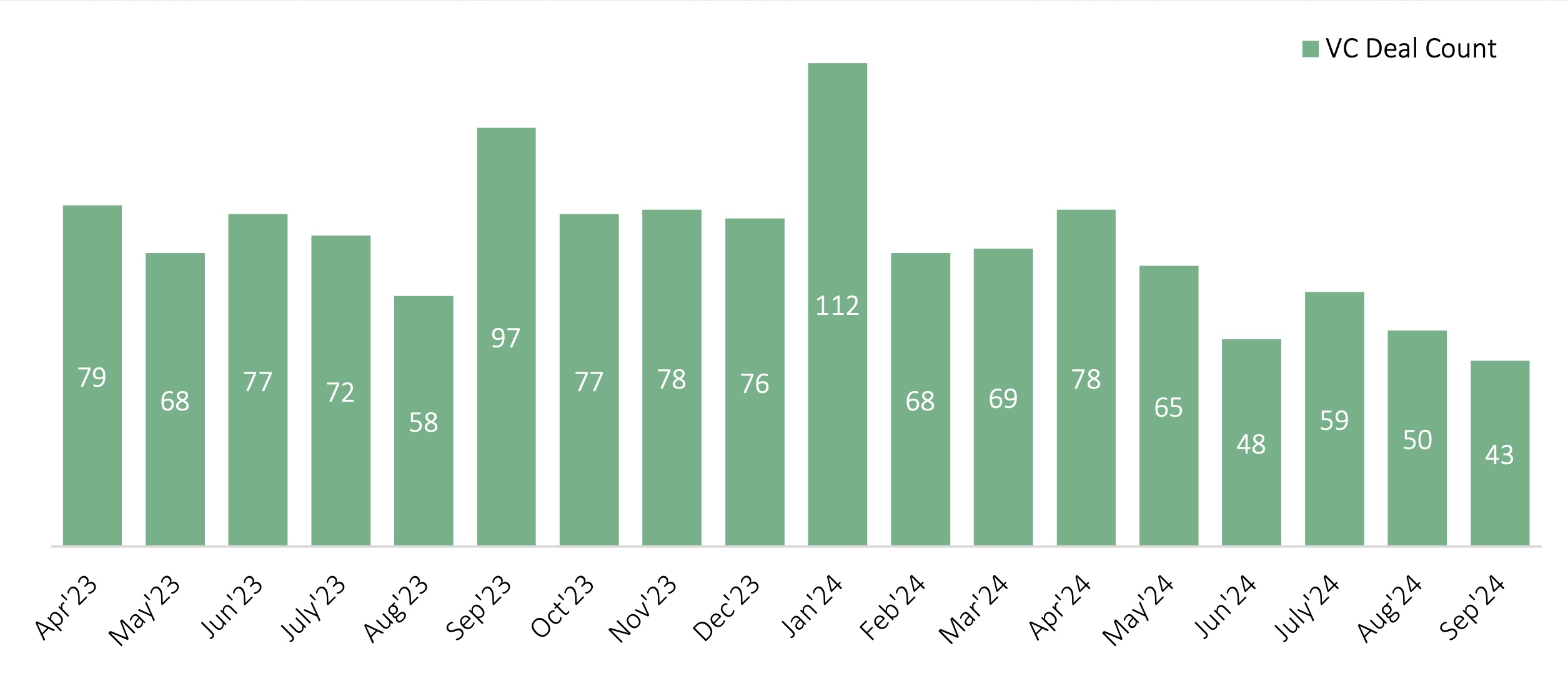

Computer Vision & Vision AI M&A Deal Volume by End Vertical – Trailing Two Years

Computer Vision & Vision AI M&A Deal Volume by End Vertical – Trailing Two Years

Potential Legal Concerns with Large Vision Model’s Deployment on Public Cameras

Legislation like the EU’s General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) are being applied to govern how data from AI-enhanced cameras is processed and stored, particularly regarding transparency and consent. Under the CCPA, businesses must disclose how personal data, such as facial recognition or behavioral patterns, is used, and individuals have the right to opt out of data collection. In the U.S., cases like Carpenter v. United States have set important precedents for digital privacy, with the Supreme Court ruling that individuals have a reasonable expectation of privacy over certain types of digital data, even when collected through third-party technology. In addition, the United States v. Chatrie case, which is currently ongoing, addresses the extent to which AI-powered surveillance technologies can be used by law enforcement without infringing on Fourth Amendment rights. This builds on the precedent set in Carpenter v. United States, where the Supreme Court ruled that accessing cellphone location data without a warrant is unconstitutional, signaling the courts’ sensitivity to privacy issues posed by advancing surveillance technologies.

Covered in detail in the full report:

- Trends on Financing Volume by Sector and Vertical

- M&A Volume by year and Key Q3 Deals

- Legal and Regulatory Concerns around Large Vision Models

- Key Emerging Vision AI start-ups

- Key Vision AI Buyers by Sector

For the remainder of the report, visit the Woodside Capital Partners website.

About WCP

Woodside Capital Partners is a leading technology investment bank specializing in sell-side M&A. We leverage our operational experience in various industries to drive exceptional results for our clients.

The 1H 2024 Computer Vision Snapshot can be found here.

Additional industry reports from WCP can be found here.