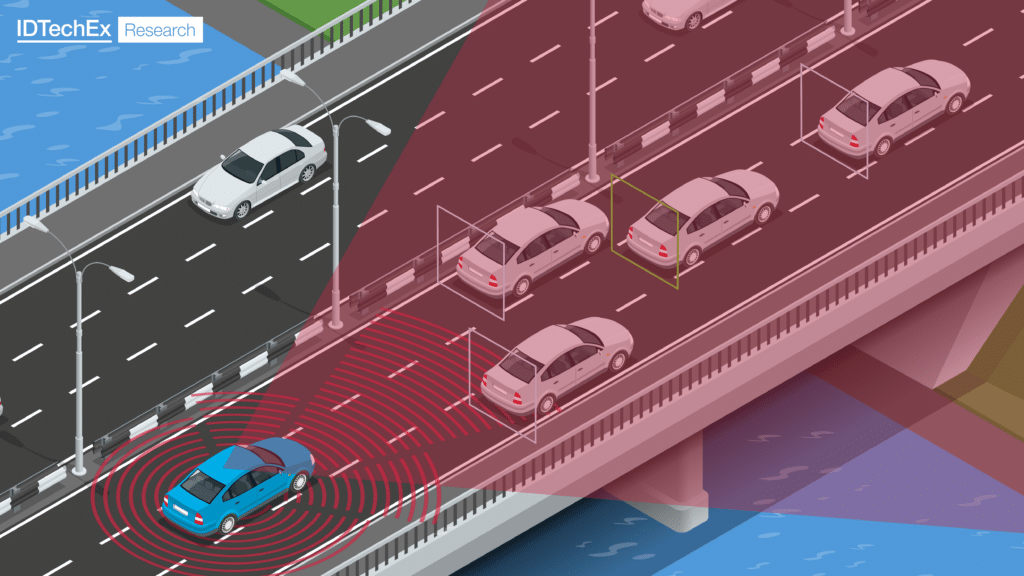

A vehicle using radar and cameras to detect traffic ahead.

LiDAR has been touted as a solution to the automotive industry’s endeavor to build safer and completely driverless cars, working towards a world with zero road fatalities and more accessible transport. So, after a decade of development, testing, trials, funding, partnerships, acquisitions, mergers, etc, where is it? Why are there not more cars on the road running LiDAR? IDTechEx‘s new report, “Autonomous Vehicles Market 2025-2045: Robotaxis, Autonomous Cars, Sensors“, explores the automotive market from the perspective of autonomous driving and, in doing so, highlights some key trends in the adoption of LiDAR compared to other solutions. It seems that outside of China, there is a decreasing appetite for LiDAR, with other solutions meeting the needs of OEMs, bringing higher levels of automated driving to market.

Growing performance of cameras, AI, and radar

One of the reasons why LiDAR might not be seeing as much uptake as expected is the growing performance of its competition. The automotive industry hasn’t been a particular pioneer of camera technologies, with sensor technologies lagging behind other industries, such as smartphones and digital cameras. This is with perhaps the exception of dynamics range, with the ability to cope with large brightness differences in live video data a critical challenge in the automotive industry that hasn’t existed in other camera markets. This has led to automotive cameras having industry-leading dynamic ranges. Even so, the bottleneck for adopting high-resolution cameras in the automotive market has likely been processing power. But this is a barrier that is reducing as new ADAS (Advanced Driver Assistant Systems) and AD (Autonomous Driving) SoCs (System on Chip) come to market.

Semiconductor players like Nvidia, Mobileye, and Qualcomm are bringing chips to market that can handle video feeds from multiple 8MP cameras. They can fuse multiple feeds and generate a detailed 360° representation of the vehicle’s surroundings. Coupled with AI, this is enough for some players to build a 3D representation of the world surrounding the vehicle. Tesla is the most famous example of a carmaker that is completely forgoing LiDAR, and radar for that matter, in the pursuit of a pure vision-based system. This is intuitively justifiable; after all, if humans can drive using just red, green, and blue, why shouldn’t cars?

4D imaging radar can improve the performance of radar such that they can understand more complex situations, such as separating the car from the bridge in a detection. Expanding on this, next generation radars will detect a person next to the car under the bridge.

4D imaging radar can improve the performance of radar such that they can understand more complex situations, such as separating the car from the bridge in a detection. Expanding on this, next generation radars will detect a person next to the car under the bridge.

Tesla is somewhat of an outlier here, and while the rest of the market isn’t convinced by LiDAR, it is overwhelmingly in support of radar + camera solutions. Look at any of the vehicles on the market with level 2+ technologies, meaning the driver can take their hands off the wheel so long as they keep an eye on the road. The vast majority of them will use a combination of cameras and radars to monitor the environment, and with good reason. Radar provides the most robust form of perception, practically impervious to snow, heavy rain, fog, direct light, darkness, object color, and visual reflectivity, all while providing distancing and velocity information. Radar’s Achilles’ heel has been its resolution. This was the stick with which LiDAR could beat radar, but the stick is weakening. The offerings from tier-one radar suppliers have been growing in performance, while startups have technologies that can compete with LiDAR on angular resolution. When the improved performance is combined with the radar’s general robustness and relative cheapness, the additional value of LiDAR quickly diminishes.

LiDAR is having more success in China

The arguments above are true in the West, but IDTechEx’s report “Autonomous Vehicles Market 2025-2045: Robotaxis, Autonomous Cars, Sensors” found that the story is different in China. China has not quite reached the same milestones as Europe and the US yet in terms of deployments of higher levels of autonomous vehicles for general public use. Hands-free driving is not technically legal in China, although OEMs like to push the limits here, and mind-off driving, like Mercedes and BMW offer in Germany and the US, isn’t either. Despite this, a surprising number of Chinese OEMs offer sophisticated ADAS systems, with advanced sensor suites that include flagship SoCs from Nvidia, many high-resolution cameras, typically five radar, and LiDAR.

In addition to sporting LiDAR and top-end semiconductor tech, these vehicles are also priced very competitively. IDTechEx found a selection of vehicles in the Chinese market priced around US$40,000, all of which were battery electric with good range, lots with multiple flagship Nvidia chips, and all with at least one LiDAR. For comparison, a car with those specs in the West would be upwards of US$100,000. So, how do Chinese automakers get LiDAR at such a low price point? And, without level 3 (hands-off, mind-off) driving available to the public, why do they bother?

IDTechEx thinks the answer boils down to three key reasons. Firstly, Chinese LiDAR companies have been able to grow and scale production quickly. RoboSense is a leading example and has a high market share of automotive deployments in China. Secondly, IDTechEx thinks these cars are being built ready for a change in regulation. Once level 3 technologies are allowed on the road, an over-the-air update can be deployed to unlock their full potential. Thirdly, and finally, IDTechEx thinks that LiDAR has been successfully marketed as an enabler of greater safety, leading customers to care more about whether their car has LiDAR or not.

At least two of those reasons don’t carry over to the Western markets: LiDAR is not as cheap, and there seems to be no conflation between LiDARs and added safety. While the West is building cars for higher levels of autonomy, camera and radar systems seem adequate for most level 2+ vehicles, so why add an expensive LiDAR?

IDTechEx’s report, “Autonomous Vehicles Market 2025-2045: Robotaxis, Autonomous Cars, Sensors”, covers the autonomous consumer vehicle market and emerging robotaxis. It explains what technologies are available from different OEMs and how they can be used in each of the key automotive markets: the US, Europe, China, and Japan. It also details the growing robotaxi market, predicting future deployments and the size of the industry over a 20-year forecast period.

To find out more about this IDTechEx report, including downloadable sample pages, please visit www.IDTechEx.com/AutonomousCars.

For the full portfolio of autonomy market research available from IDTechEx, please see www.IDTechEx.com/Research/Autonomy.

Dr James Jeffs

Principal Technology Analyst, IDTechEx

About IDTechEx

IDTechEx provides trusted independent research on emerging technologies and their markets. Since 1999, we have been helping our clients to understand new technologies, their supply chains, market requirements, opportunities and forecasts. For more information, contact [email protected] or visit www.IDTechEx.com.