According to IDTechEx‘s latest report, “Automotive Radar Market 2025-2045: Robotaxis & Autonomous Cars“, newly established radar startups worldwide have raised nearly US$1.2 billion over the past 12 years; approximately US$980 million of which is predominantly directed toward the automotive sector. Through more than 40 funding rounds, these companies have driven the implementation and advancement of radar technologies in key areas such as autonomous driving and Advanced Driver Assistance Systems (ADAS). The funding peak occurred in 2021 and 2022, propelled by the surge in robotaxis and Level 4/5 autonomous driving. While there has been a modest uptick in 2024, investment levels are unlikely to reach the previous highs.

This influx of capital can be attributed to three key drivers. First, the automotive industry’s growing demand for safety and robust environmental perception highlights radar’s all-weather, high-reliability detection capabilities. Second, the rise of electric vehicles and robotaxis has opened up broader application scenarios for radar. Finally, emerging technologies such as 4D imaging radar, high-resolution radar, and radar-on-chip solutions continue to improve sensing accuracy and data fusion, maintaining long-term investor confidence in the radar market.

Radar startup funding

Radar startup funding

During this funding wave, companies like Arbe, Uhnder, and Mobileye have taken the lead by launching multiple high-performance radar products. These solutions utilize innovations such as high-resolution sensing and digital beamforming (DBF), leading to notable gains in detection accuracy and processing speed. Concurrently, advancements in semiconductor manufacturing have decreased production costs, enabling OEMs to integrate radar systems into premium models and across a broader range of mass-market vehicles.

Although the 2021-2022 funding boom has cooled, 2024 remains a critical year for potential investor activities. IDTechEx projects that radar technology will move into a “practical development” phase, wherein mass-production orders and more mature autonomous-driving business models catalyze the next growth cycle. Industry players must address challenges in three key areas: technology innovation—such as 4D imaging, ultra-wideband, and multi-functional integration; cost control—ensuring high performance while continuously reducing costs; and commercial adoption—forming close partnerships with Tier 1 suppliers and OEMs to facilitate large-scale deployment.

4D imaging radar: Breaking the resolution barrier and advancing toward higher-level autonomy

4D imaging radar: Breaking the resolution barrier and advancing toward higher-level autonomy

Previously, radar’s limited vertical resolution often led to misdetections in scenarios like overpasses. When a vehicle is parked under a bridge, conventional 3D radars might merge the overpass structure with the car’s roof into a single detection, causing the system to misjudge clearance and overlook collision risks. As the industry shifts toward higher-level autonomy, vehicles must accurately distinguish bridges, other vehicles, and pedestrians—potentially hundreds of meters ahead—and respond safely.

To address these challenges, startups and Tier 1 suppliers are expediting the development of 4D imaging radar. Compared to 3D radar, 4D imaging radar offers more granular object data across horizontal, vertical, depth, and velocity dimensions. Leveraging multi-antenna arrays and digital beamforming (DBF), 4D radars significantly enhance spatial resolution and object classification, reducing false alarms and missed detections in complex traffic conditions.

Accelerated ADAS adoption and L3 models driving wider radar deployment

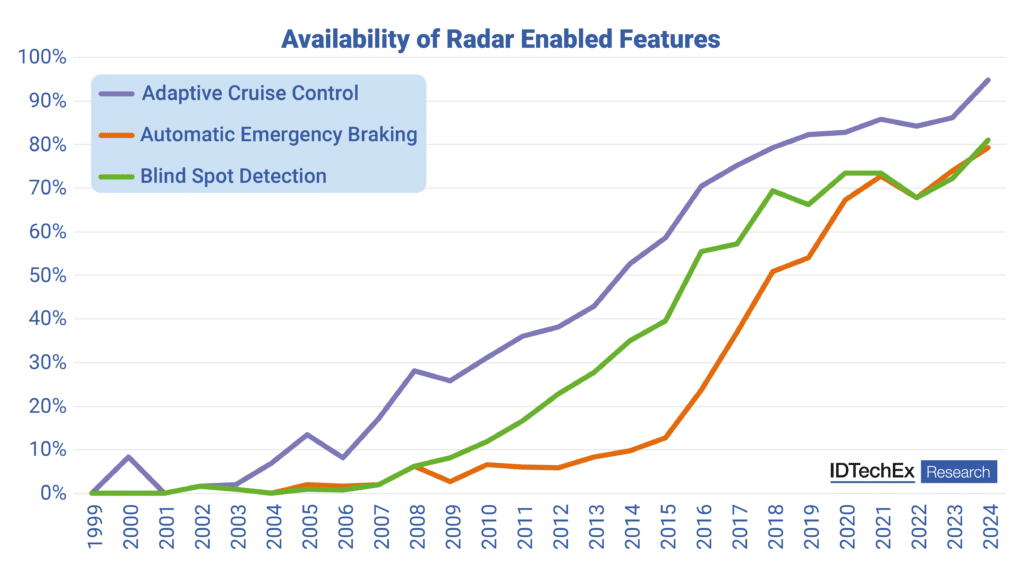

Availability of radar enabled features

Availability of radar enabled features

IDTechEx’s review of automaker brochures over the past 25 years shows that the use of radar in ADAS systems has expanded dramatically in the last two decades. A decade ago, radar-enabled features like Adaptive Cruise Control (ACC) were limited to luxury models. Today, with decreasing sensor costs and tighter safety requirements from organizations such as NCAP, functionalities like Automatic Emergency Braking (AEB) and Blind Spot Detection (BSD) have become increasingly prevalent. In 2023, 71% of newly sold vehicles are equipped with AEB—a 16-percentage-point increase over 2020—while ACC adoption reached 55%, up from 52% in 2022 and 40% in 2020. BSD usage has also climbed from 28% in 2020 to 40% in 2023. These figures reflect consumers’ growing focus on safety, and efforts by OEMs and suppliers to bring more advanced radar sensing solutions to a broader range of vehicle segments.

Of particular note is BSD’s trajectory toward 360-degree monitoring, which requires multiple short-range radars placed around the vehicle and is complemented by forward radar to enable safety features such as Pedestrian Automatic Emergency Braking (PAEB) in more complex scenarios. PAEB uses radar, cameras, and intelligent algorithms to detect crossing pedestrians, bicycles, or other obstacles when turning or exiting side roads, issuing warnings, and applying automatic brakes if necessary. As more Level 3 autonomous models enter the market, radars will move beyond driver assistance to serve as a critical layer in environmental perception and advanced decision-making. IDTechEx anticipates strong growth for radar-driven ADAS and autonomous functions in the coming years, offering substantial opportunities across the automotive value chain.

The IDTechEx report, “Automotive Radar Market 2025-2045: Robotaxis & Autonomous Cars,” provides a comprehensive analysis of the global automotive radar landscape, covering radars for autonomous cars & robotaxis, long-range radar, short-range radar, radar cocooning, 4D imaging radar, high-channel-count radars, semiconductor technologies for radar, waveguide antenna, and detailed market forecasts. In addition to these technical insights, the report offers assessments of value chain positioning, business models, and forward-looking projections—supported by data from primary research and practical economic models.

To learn more about this IDTechEx report and access downloadable sample pages, please visit www.IDTechEx.com/Radar.

For the full portfolio of robotics and autonomy market research available from IDTechEx, please see www.IDTechEx.com/Research/Robotics.

Shihao Fu

Technology Analyst, IDTechEx

About IDTechEx

IDTechEx provides trusted independent research on emerging technologies and their markets. Since 1999, we have been helping our clients to understand new technologies, their supply chains, market requirements, opportunities and forecasts. For more information, contact [email protected] or visit www.IDTechEx.com.