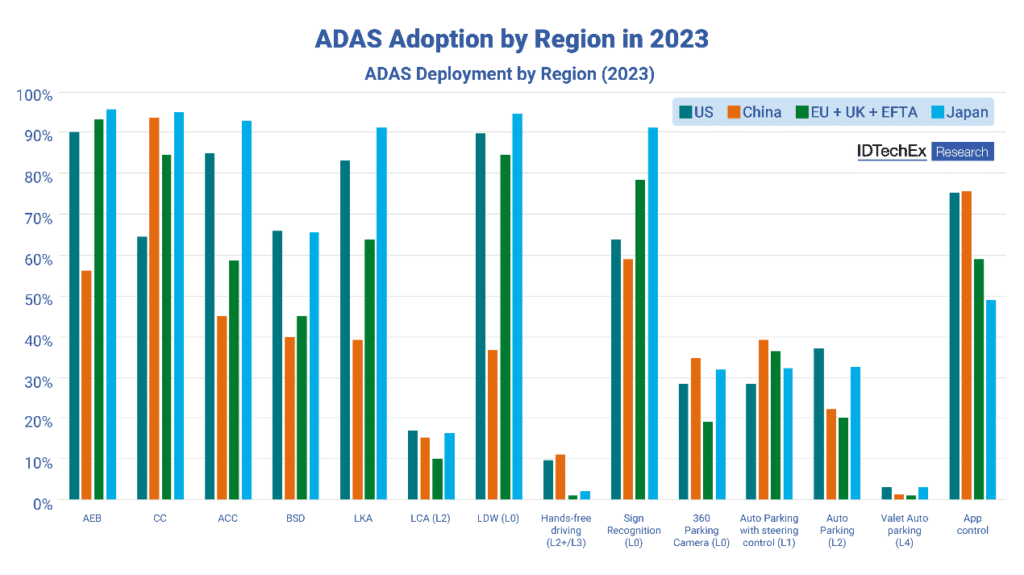

14 ADAS Features Deployed in EU.

Privately owned Level 3 autonomous vehicles encountered significant regulatory setbacks in 2017 when Audi attempted to pioneer the market with the L3-ready A8. Regulatory uncertainty quickly stalled these ambitions, delaying the introduction of true L3 autonomy. By 2021, a clearer regulatory framework emerged under UNECE guidelines, affecting Europe and select global markets. However, national-level adoption has remained cautious, with only Germany and Japan actively deploying limited numbers of certified vehicles. Germany currently leads with Mercedes-Benz and BMW models, and Mercedes-Benz expanded certification to Nevada and California in the U.S. in 2023. Nevertheless, global progress in Level 3 deployment remains slow.

In contrast, the Level 2+ market is gaining substantial momentum. Systems such as GM’s Super Cruise and Ford‘s BlueCruise have expanded availability significantly, both in terms of more than 20 compatible vehicle models and 750,000 miles of roadway coverage in the US. Europe, previously cautious, has begun permitting hands-free driving through regulatory exemptions, with formal legislation expected soon. Meanwhile, China’s Level 2+ market is rapidly advancing, with Tesla planning to introduce its Full Self Driving (FSD) capabilities there by 2025. IDTechEx closely tracks these developments and forecasts significant market growth ahead in their new report on the topic, “Passenger Car ADAS Market 2025-2045: Technology, Market Analysis, and Forecasts“.

Automakers Accelerate Deployment of L2+ Features in Europe

BMW: The First to Enable Hands-Free Driving at 130 km/h

Despite Europe currently trailing behind the U.S. and China in Level 2+ adoption, traditional European automakers, led by Mercedes-Benz and BMW, are strategically expanding their presence. BMW achieved a milestone as the first European automaker to offer hands-free driving at speeds up to 130 km/h with its Highway Assistant feature, available in the new 7 Series and i5 models. The system provides automatic lane centering, adaptive cruise control, and autonomous lane-changing capabilities, although drivers must remain attentive and prepared to intervene.

Mercedes-Benz: Pioneering L3, Expanding L2+

Mercedes-Benz, although pioneering Level 3 technology with its Drive Pilot system, continues expanding its Level 2+ capabilities. Initially approved in 2022 for hands-off, eyes-off driving at speeds up to 60 km/h in traffic congestion, the Drive Pilot’s permitted speed is set to rise to 95 km/h by late 2024. Still, for regular highway scenarios, Mercedes-Benz predominantly relies on comprehensive Level 2+ systems, including Adaptive Cruise Control (ACC), Lane Keeping Assist (LKA), Automatic Emergency Braking (AEB), and automated lane changing.

Volkswagen Group: Strengthening L2+ Across Its Brands

Volkswagen Group, including brands VW, Audi, and Porsche, has also increased investment in Level 2+ functionalities, notably through the Travel Assist system. This system offers advanced lane centering, adaptive cruise control, and limited automated lane changes under driver supervision. While Audi had early ambitions for Level 3 technology, regulatory constraints have shifted its strategy towards enhancing Level 2+ and driver monitoring systems instead.

Tesla: The Benchmark for L2+ AI-Driven Autonomy

Tesla maintains its leading position in L2+ through its Autopilot system, offering standard adaptive cruise control and lane centering, along with Enhanced Autopilot features such as automatic lane changes, automatic parking, and highway navigation assistance. EU regulations currently impose restrictions, including manual lane-change confirmations and periodic driver engagement checks. Nevertheless, Tesla’s HW4.0 approach continues to set benchmarks, intensifying competition in the market.

IDTechEx’s new report, “Passenger Car ADAS Market 2025-2045: Technology, Market Analysis, and Forecasts”, delivers an extensive analysis of global SAE Level 2+/L3 market, profiling key industry participants (including Tier1 suppliers, OEMs, ADAS Software & platform providers), detailed sensor suite comparisons, SoC performance evaluations, and end-to-end architectures. It also includes detailed 20-year forecasts for more than 14 ADAS features, covering adoption rates, sales volumes, and revenue projections. According to IDTechEx, global adoption of L2+/L3 functionalities is expected to exceed 50% by 2035, with L2+/L3 revenues alone surpassing US$4 billion in Europe by 2042, contributing to a total ADAS feature market of over US$16 billion.

To find out more about this report, including downloadable sample pages, please visit www.IDTechEx.com/ADAS.

For the full portfolio of autonomy related market research available from IDTechEx, please see www.IDTechEx.com/Research/Autonomy.

Shihao Fu

Technology Analyst, IDTechEx

About IDTechEx

IDTechEx provides trusted independent research on emerging technologies and their markets. Since 1999, we have been helping our clients to understand new technologies, their supply chains, market requirements, opportunities and forecasts. For more information, contact [email protected] or visit www.IDTechEx.com.