By Brian Dipert

Editor-In-Chief

Embedded Vision Alliance

Senior Analyst

BDTI

Last November, EVA founder Jeff Bier attended VISION 2011, a trade show held in Stuttgart Germany. Part of Jeff's motivation to travel to VISION 2011 was his participation in a panel discussion on the topic of the future of embedded vision. And this editor also wrote an article published coincident with the show, in the machine vision magazine INSPECT. But more generally, Jeff found his time at VISION 2011 very useful, both in meeting with potential Embedded Vision Alliance members and in getting a pulse of the machine vision industry and its expansion and transition into the embedded vision future.

VISION is the premier machine vision show, focusing on factory automation and inspection markets. These markets comprise a ~$10B USD/year business, growing at a 7-8% average annual rate. The VISION trade show comprised roughly 350 exhibitors, from all over the world, although a dominant percentage of the total were from Germany. Next in line, per Jeff's estimates, were U.S.-based companies, followed by those from other European countries and then from other geographies. Machine vision subsystem manufacturers, integrators, distributors, and systems manufacturers were all represented in the exhibitor mix.

Roughly 7,000 people attended VISION 2011, predominantly from Europe, with roughly 60% of the total from Germany. This percentage split is reflective both of the conference's location and of the business opportunity; European manufacturing combines both high labor costs and high quality expectations, thereby creating a "perfect storm" opportunity for automated vision inspection. Conversely, the Chinese version of the AIT (Austrian Instutute of Technology, Europe's dominant machine vision association) has only recently formed. The more mature U.S. equivalent of the AIT is the AIA, the American Imaging Association.

Machine vision is nascent in China and Korea due to two primary factors; manufacturing process changes tends to be resisted, and labor costs are low. Still, the high quality expectations of European and U.S. "brand names" that partner with Asian contract manufacturers are driving some conversions to automated inspection; Apple's contract manufacturers in China, for example, represent 40% of the computer vision opportunity in that country. More generally, as I wrote in mid-November, numerous industry "niches" exist worldwide, each of which is sufficient in size to support one or more automated inspection suppliers.

"Embedded vision has currency in this space," Bier told me soon after returning from the show. Specifically, he's referring to machine vision without the workstation, with the image analysis function sometimes located within the camera and other times in a separate hermetically sealed module. In Bier's opinion, based on the companies he spoke with, the trend is moving away from PC-based processing for a number of reasons, including the need for more reliable systems (from both hardware and software standpoints), as well as for inspection equipment that can stand up to the difficult environmental conditions often found in manufacturing facilities.

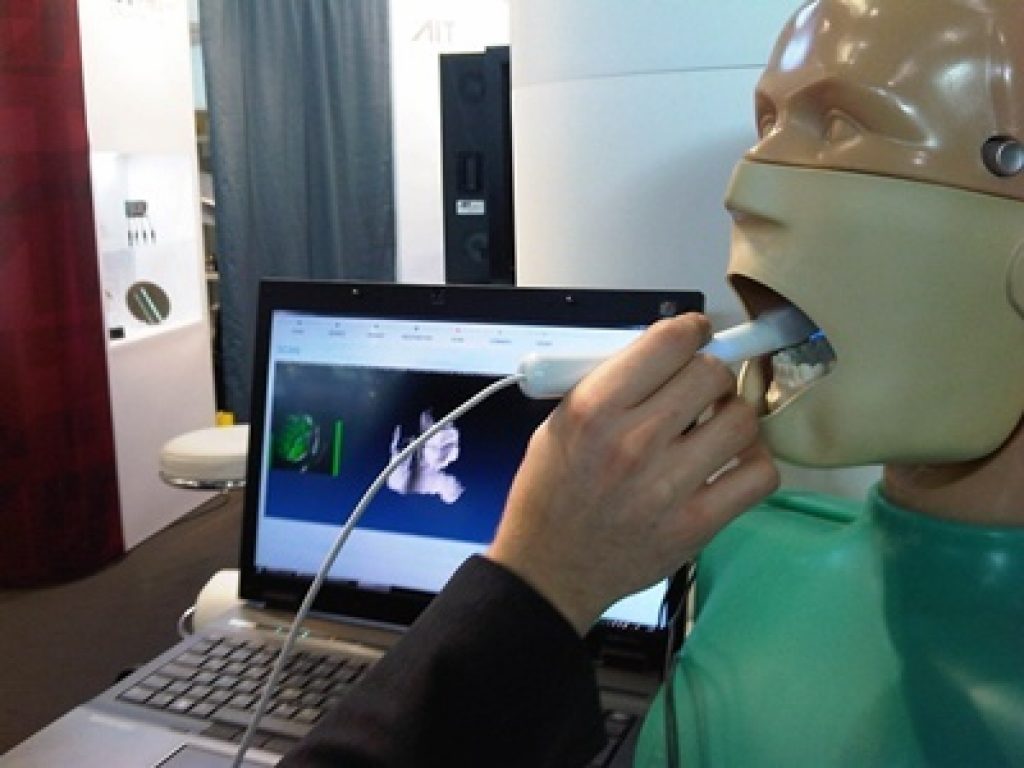

One noteworthy embedded vision product which won the VISION Award 211 and was developed at AIT and commercialized by a.tron3D is a camera used by dentists and small enough to be placed in a patient's mouth, where it assembles detailed 3-D images of teeth. Another interesting vendor is Silicon Software, originally a Germany-based computer frame grabber board manufacturer that more recently has expanded into embedded vision products by creating a Xilinx Spartan-6-based module. In addition to the hardware that Silicon Software develops, the company has also created development tools that enable users to program the FPGA graphically, using machine vision function blocks, with no VHDL or Verilog RTL coding required.

After surveying the exhibitors at VISION 2011, Bier's conclusion is that the automated inspection market is quite crowded with suppliers. "Undoubtedly, some of the suppliers of machine vision products for factory automation would benefit from entering new markets," Bier said. "Embedded vision offers a new opportunity for them to do so, since it enables them to create lower-costm lower-power and smaller systems." In addition, Bier believes that low-cost embedded vision technology developed for high-volume consumer applications is likely to "move upstream," offering opportunities for innovative machine vision suppliers to create lower cost, smaller, lower-power products that may give them access to new machine vision markets.

The VISION 2011 panel discussion was moderated by Peter Ebert, editor-in-chief of INSPECT. In addition to Bier, speakers included Kamalina Srikant of Embedded Vision Alliance member company National Instruments, Carsten Strampe of IMAGO Technologies GmbH, and Mikael Bodin of SICK IVP. Although the panelists expressed a diversity of perspectives, there was general agreement that more capable, less expensive, more energy-efficient embedded vision equipment is opening up new markets for machine vision suppliers. "If you could make a system for $100," Jeff postulated on the panel, "or one small enough to fit inside the product being inspected, what new markets could you open up, and what effect might that have on your business?"