This market research report was originally published at Yole Développement’s website. It is reprinted here with the permission of Yole Développement.

MARKET DYNAMICS:

-

Key figures:

The APU market should generate US$44 billion of revenue for designers in 2021.

Revenue for CPUs are expected to grow to US$70 billion in 2021.

GPUs continue to grow, with US$15 billion revenue in 2020 reaching beyond US$25 billion in 2025

-

US-China trade disputes – Status:

China is looking to preserve the Huawei’s long-term viability.

China could still take retaliatory action against US-based companies, but would be sensible to wait for any policy changes the Biden administration might make.

In the meantime, where Huawei has been restricted from Western markets, Xiaomi is emerging as a formidable player, at least in the personal device markets.

-

COVID-19 outbreak:

Economic uncertainty and supply chain challenges impacted both supply and demand of certain luxury consumer electronics in the first half of 2021.

The production of electronic goods remained somewhat strong, as we saw foundries and chip designers fair well through the whole of 2021.

THE PROCESSOR LANDSCAPE IS REORGANIZING AMIDST GLOBAL TRADE DISPUTES AND DESIGNER INNOVATIONS

While finding new application, and sustaining the established ones, CPUs, GPUs, and APUs hold the keys to the next ten years of the processor market.

Recent events have created the potential to re-align the massive processor market. These include: Apple turning to in-house designs for Mac processors, the meteoric rise of GPU accelerated coprocessing in the datacenter and restructuring the APU supply chain around China-US trade tensions.

According to John Lorenz, Technology & Market Analyst, Computing & Software at Yole Développement (Yole):“The APU is the central chip for managing and executing the many functions of which modern “smart” devices are capable. In fact, as more consumer devices become always on and always-connected, the APU becomes an attractive alternative to its traditionally more power-hungry x86-based counterparts”.

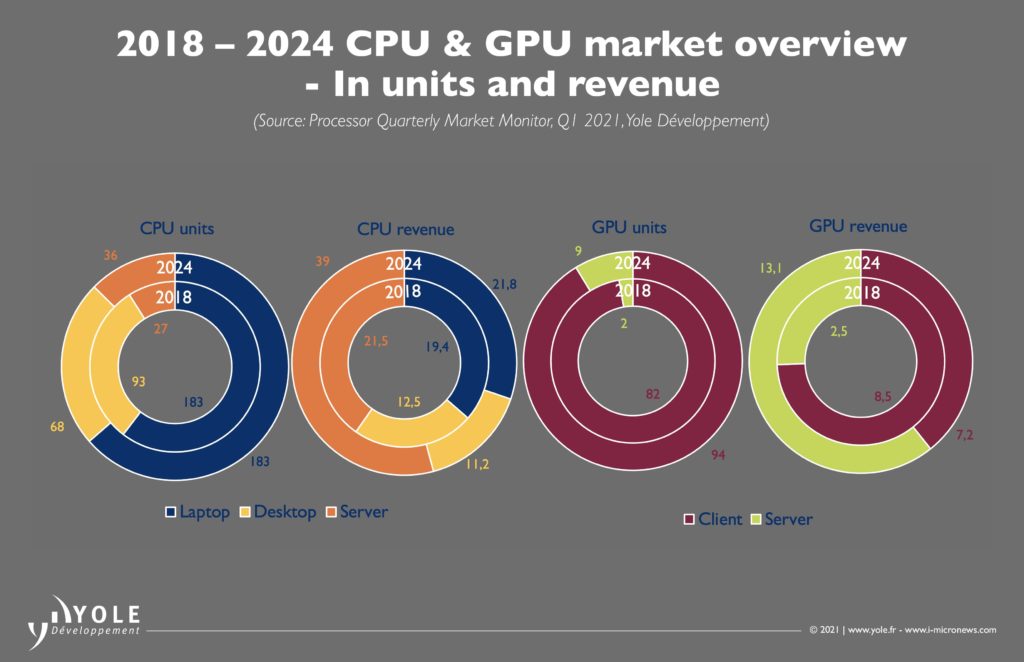

Appearing across the connected consumer device spectrum, APUs saw US$37 billion of revenue in 2020 alone. Adding in CPUs for PC and server (US$61 billion), and discrete GPUs for PC and server (US$17 billion), the bulk of this processor market generated US$115 billion of revenue for their designers.

The lines between these markets start to blur with recent developments, such as Apple turning to an APU solution in their PCs. If the M1 shows enough success, this market could see more x86-based sockets moving toward APUs.

THE PROCESSOR MARKET: TUMULTUOUS 2020 LEADS TO AN INTERESTING 2021 | QUARTERLY MARKET MONITOR

Even setting aside the roller-coaster of COVID-19, 2020 brought changes to the traditional processor landscape, announces Yole Développement (Yole), in its Processor Quarterly Monitor, Q1 2021. Apple’s successful implementation of in-house processor designs for select new MacBook and Mac Mini computers could open the door to more ARM-based PCs. Intel’s confirmation that it is outsourcing some production may show some vulnerabilities of the IDM business model. And AI training and inference growing from the datacenter to the edge hints at the next realm of big semiconductor market growth.

The market research and strategy consulting company, Yole invite you to discover today the status of these markets, one year removed from the start of the COVID-19 pandemic… Discover the full article on i-Micronews.

WHAT’S NEXT?

The long-term trend within the application processor industry is for OEMs to seek differentiation and demand increasing processing power for end-products, while living within the power and BOM constraints of high mobility. Similarly in the microprocessor space, the system designers seek to deploy ever-increasing computing capabilities at ever-increasing efficiencies. In some cases, this calls for new hardware and software as in AI training and inference. Designers, IP licensers, and manufacturers partner to meet those demands by adding capabilities to the traditional areas of computing and graphics, as well as the emerging focus of innovation in neural network processing, deep learning, and artificial intelligence.

For Tom Hackenberg, Principal Analyst, Computing & Software at Yole: “In fact, artificial intelligence enablement (through standalone or embedded AI accelerators) is the newest differentiator for processor designers and OEMs. Packing ever-increasing computational capabilities into semiconductor devices has long been the trend for the whole of computing industry history. The next decade of processors will be no different. However, we are witnessing a slowdown in the rate of cost decline for a unit of computing capability, and therefore processor designers will have a choice to make: continue computational improvements at historical levels and accept the increasing costs, or adjust their innovation to match the rate of cost decline and live within historical BOM and margin band”.

Yole’s analysts expect the decision designers make will depend on the specifics of their target markets. The dynamics of players within this industry is continuing to evolve, and a quarterly market monitor is a critical tool for those looking for the advantage of insight.

Yole’s Processor Quarterly Market Monitor will be published every beginning of March (Q1), June (Q2), September (Q3) and December (Q4)… Aim of these services is to provide an in-depth coverage of rapidly changing market dynamics and main players’ status and strategy.

Also, Yole’s partner, the reverse engineering and costing company System Plus Consulting released the Apple M1 System-on-Chip report. To point out all the details of Apple M1, System Plus Consulting’ report features multiple results: a floor plan analysis to understand the high-level chip architecture with IP block area contribution measurements, a front-end construction analysis that reveals the most interesting features of the new TSMC 5nm process, a back-end construction analysis of the packaging structure, and a detailed manufacturing cost analysis. A detailed description is available: here.

In addition, the market research and strategy consulting company Yole released several computing-related reports. Discover them on i-Micronews.

Stay tuned to i-Micronews to get further information about our activities!

Acronyms:

- APU: Accelerated Processing Unit

- CPU: Central Processing Unit

- GPU: Graphics Processing Unit

- OEM: Original Equipment Manufacturer

- BOM: Bill of Materials

- AI: Artificial Intelligence

- IP: Integrated Processor