This market research report was originally published at Yole Développement’s website. It is reprinted here with the permission of Yole Développement.

Processing for ADAS and infotainment will expand threefold in the next five years…

OUTLINE:

-

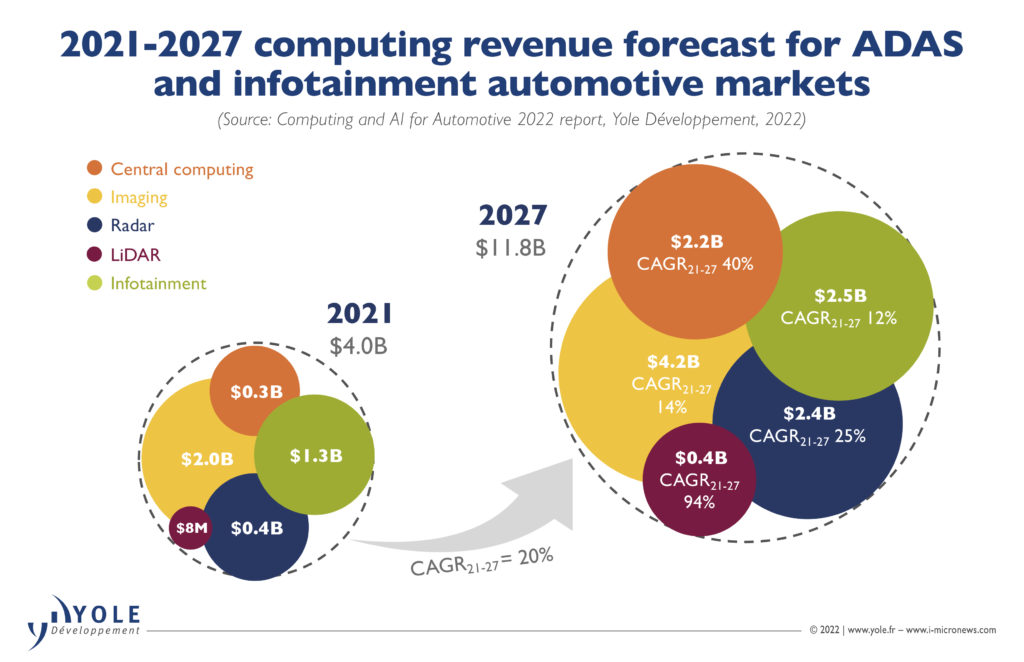

Computing revenue for the ADAS and infotainment processor market segments is increasing quickly, with a 19% CAGR expected between 2021 and 2027.

-

As ADAS, in-cabin sensing, and infotainment are driving the computing demand, this whole industry will be worth more than US$12 billion in 2027.

-

Competition in this domain is fierce with a large diversity of players.

Lyon, France, May 16th 2022 – Computing revenue for ADAS and infotainment processors is growing even faster, driven not only by the growing penetration of these systems but also by the centralization trend . An increasing ASP – the consequence of the recent crises, including COVID-19 and semiconductor shortages, and the integration of more functionalities into processors – is also driving up computing revenue. AI is one of the factors which explain the growing revenue. More and more AI units are required to accelerate ADAS perception layers and enable real-time understanding of the car’s environment. According to Yole Développement (Yole), this market segment is expected to reach US$1.1 billion in 2027.

The market research and strategy consulting company Yole has developed comprehensive and accurate computing & AI expertise, with specific investigations fully dedicated to automotive, consumer, and data center applications. All year long, analysts deliver significant analyses, including technology and market reports and quarterly market monitors… More information.

Today, Yole’s computing team releases the report, Computing and AI for Automotive 2022. This technology and market study gives an overview of computing for ADAS and AD , in-cabin sensing, and infotainment. This report provides a scenario for AI within the dynamics of the autonomous automotive market and presents a comprehensive understanding of its impact on the overall semiconductor industry. The company also delivers an in-depth analysis of the ecosystem and players and offers key technical insights into technical innovations and business challenges.

Adrien Sanchez, Technology & Market Analyst, Computing & Software at Yole, asserts: “There is growing diversity among carmakers. Some traditional companies are involved in the development of autonomous functions. Some new electric and disruptive carmakers are creating a new consumer audio-visual paradigm. Last year, at Yole, we saw some traditional carmakers announcing processor developments, as did the electric car giant Tesla. But considering the challenges and the huge investment required, we expect most carmakers will not fully develop an entire chip. Indeed, they will instead form partnerships and build buffer stocks.”

Focusing more specifically on the processor ecosystem, the imaging ADAS processor market is today dominated by Mobileye, followed by players such as Xilinx-AMD, Toshiba, and Texas Instruments. But many players are eagerly entering the market and have already announced design wins. These include Qualcomm and Ambarella, and also many start-ups, including Hailo, Vsora, and Horizon Robotics. Most of these players are also positioning themselves for central computing processors, which is the next step for image processing. Chinese new electric car makers are front-runners in adopting this type of architecture.

For the in-cabin sensing market, the situation is different. A wider variety of solutions can be used to run the Tier-2 software solutions. Traditional automotive processor suppliers own the radar processor market. For LiDAR, most players use Xilinx’s programmable SoC . There is also some movement on the infotainment side, with a concentration of functions and the increasing importance of over-the-air updates in the carmakers’ software strategies.

With ADAS development, ever more sensors are needed to add new functionality and increase the safety of existing ones. This directly leads to an increase in the number of processors per car. Even if the trend to centralize computing is limiting the overall volume increase, the growth is still massive, comments Yole in its Computing & AI report.

Indeed, the decentralized architecture with one processor per ADAS sensor/group of sensors is expected to remain dominant in the next five years. However, the centralization trend directly implies a need for more powerful processors to handle all the different software layers coming on top of cameras, radar, and LiDAR raw data streams. The latest processor lithographic node will be used to perform these advanced tasks, with the optimal ratio between performance and energy consumption. This will result in increased processor prices.

Yole invites you to follow the automotive industry and the strategies of the computing players that comprise it on i-Micronews. Stay tuned!

Acronyms:

- ADAS: Advanced Driver-Assistance Systems

- CAGR: Compound Annual Growth Rate

- ASP: Average Selling Price

- AI: Artificial Intelligence

- AD: Autonomous Driving

- SoC: System-on-Chip