Automation can vary from level 0 to level 5 within the automotive industry, from sole reliance on driver control, all the way to completely driverless vehicles. Roboshuttles and autonomous buses will likely strive for level 5 operation as a long-term goal but are currently aiming for level 4, where driverless operation can take place within specific areas. IDTechEx‘s report, “Roboshuttles and Autonomous Buses 2024-2044: Technologies, Trends, Forecasts“, provides insights into market developments and predictions for growth in the future.

The roboshuttle market

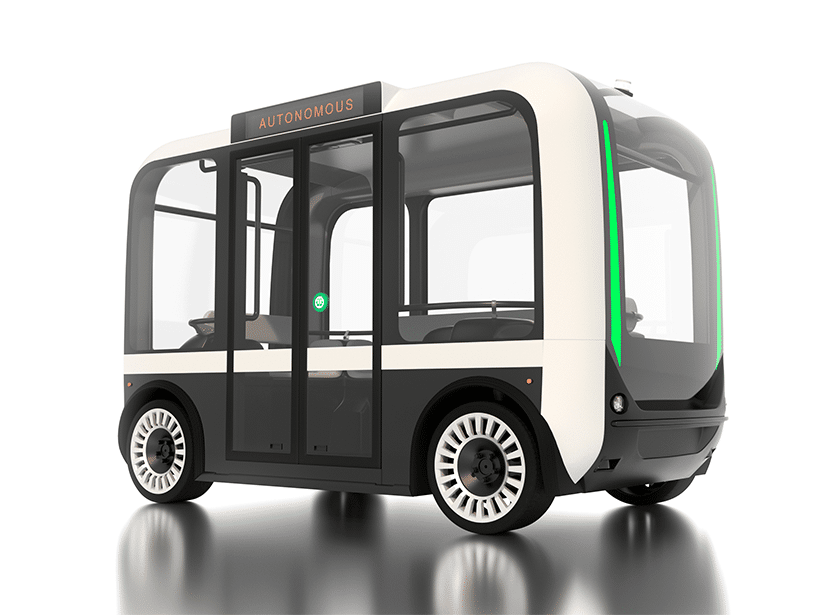

Unlike most buses, roboshuttles are designed to be small, with not-too-large capacities, making them ideal to deploy in higher numbers within small areas. Operating under level 4 driving conditions, they are driverless, efficient, and comfortable, accommodating up to 22 passengers. Despite being smaller than a minibus, the extra room allowed by having no driver means their 4-6-meter length can hold a greater capacity.

Commercialization can be tricky for roboshuttles, with many being deployed on trial but struggling to make it any further. IDTechEx reports a decline in the number of players from over 25 to just 12 since 2020, with most companies still in the early stages of development in 2023. Lack of government funding and sufficient public interest will make it tricky for roboshuttle players to reach larger trials and head on to commercialization, with many exiting the market after the first, smaller trials.

In Q2 2024, 7 out of 11 companies within the roboshuttle sector were manufacturers, with 3 companies in China participating in large-scale testing over the past 2 years, which is promising for the roboshuttle industry. Success within these trials could pave the way for other companies and potentially incentivize newer startups to emerge.

Autonomous buses – mini, midi, and city

Mini, midi, and city buses are among the various types of autonomous buses, coming in all shapes and sizes. The higher capacity of buses compared to roboshuttles, at around 100 passengers per city bus, means fewer are likely to be needed within certain areas. Being considered a key part of urban infrastructures, there is a need and desire for significant government support to encourage the development of autonomous buses.

The large number of investments required for autonomous buses to become mainstream is indicated by the limited number of players within the market – even with the help of government subsidies. The regulatory challenges faced by companies, alongside the increased challenges and slow progress of level 4 systems in larger buses, are also factors slowing down commercialization.

Examples of market success

Many passengers per week are transported along a 14-mile autonomous bus route between Ferrytoll and Edinburgh Park, demonstrating these buses’ potential to succeed within cities along medium-distance routes. The autonomous night bus project in South Korea also currently fills a gap in the market where a shortage of taxis might otherwise cause transportation concerns, again highlighting a real-world application for these buses.

Minibus companies continue to increase, according to IDTechEx, despite the declining city bus company numbers. IDTechEx outlines that these smaller buses are more likely to reach commercialization than alternatives such as roboshuttles, due to the government support available. VW‘s MOIA minibusses are already operating in Germany for city center coverage, and Aurrigo, within the UK and Singapore, is targeting airport and cargo transportation, highlighting the growing success of autonomous minibusses.

What’s next for the autonomous bus market?

The development of autonomous buses and roboshuttles is likely to continue somewhat slowly due to a lack of funding and regulatory challenges. However, IDTechEx highlights the next stages of developments within their report, and with the already commercialized examples of autonomous city buses and minibusses, success in the industry is increasingly likely. Over the next two years, IDTechEx predicts that roboshuttle trials with safety operators on board will expand, and reports that by 2030 they are likely to be commercialized without the need for operators. Despite bus developments predicted to take longer even with government support, they are likely to see commercial trials by 2030, with driverless operations across specific routes in place by 2035.

For more information, including downloadable sample pages, please visit www.IDTechEx.com/AutonomousBuses.

For the full portfolio of autonomy related market research available from IDTechEx, please see www.IDTechEx.com/Research/Autonomy.

About IDTechEx

IDTechEx provides trusted independent research on emerging technologies and their markets. Since 1999, we have been helping our clients to understand new technologies, their supply chains, market requirements, opportunities and forecasts. For more information, contact [email protected] or visit www.IDTechEx.com.