Front mounted short-range side radars enabling junction pedestrian automatic emergency braking will be a key source of automotive radar market growth.

The automotive industry has been using radar for two and a half decades. During that time, it has transformed from enabling luxury features on the most expensive cars, to being used ubiquitously for basic safety features in almost all new cars. IDTechEx‘s new report “Automotive Radar Market 2025-2045: Robotaxis & Autonomous Cars” covers all things radar, from the established market and tier-one supplier offerings to the most cutting-edge new start-ups founded in the past couple of years. This article goes through the three most important takeaways from the report. Starting with the huge growth that will be driven by side radars used in short-range applications.

New radar demand driven mostly by side radars

The global front radar market is approaching saturation. IDTechEx found that in 2023, 71% of new cars were shipped with front radars; in the US, with growing regulation on automotive safety requirements, it is 90%. As such the radar market has little room for growth from front radars alone. However, side radars are still fast-growing, with only 40% of new vehicles shipped with short-range radar-powered blind spot detection systems.

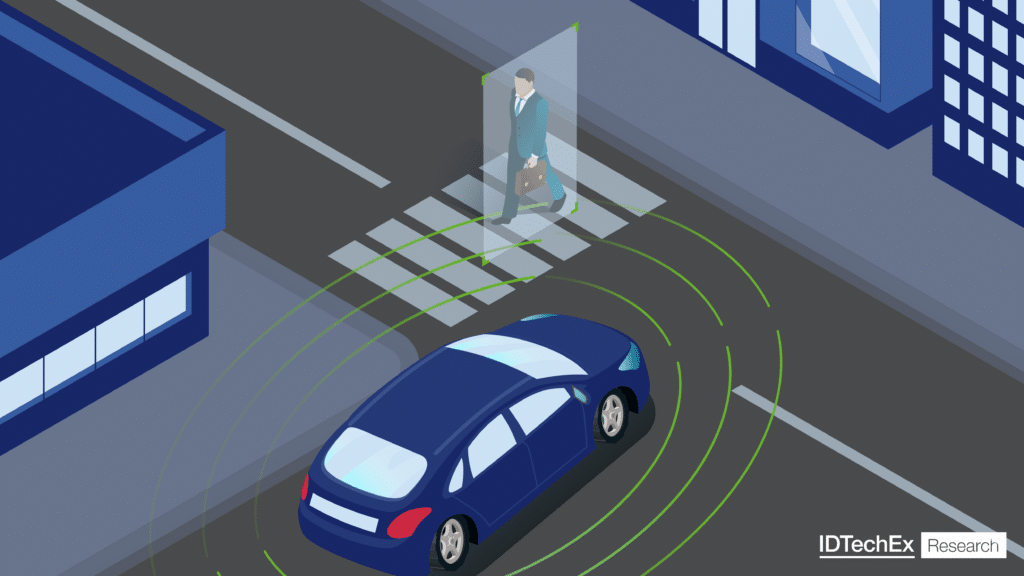

Blind spot detection applications dominate market demand for short-range radars, but an exciting area of growth is in front short-range radar applications, like junction automatic emergency braking. This requires two short-range radars on the vehicle’s front corners, which can see round corners better than the driver and activate the brakes if the car turns into a secondary road where a pedestrian is crossing. Safety rating bodies are already including these features in their arsenal of tests; in the future, these features could be mandated in updated type approval safety requirements that all new cars must follow.

Autonomy and autonomous driving will also be drivers of side radars. Level 2+ is a rapidly growing sector of the market. Cars with this technology allow drivers to remove their hands from the wheel while still watching the road. These typically require a front radar combined with four side radars, offering 360° sensing and protection.

Growing demand for high-resolution 4D radars

Just because the front radar market is approaching saturation doesn’t mean nothing exciting is happening there. Next-generation radars are now being deployed on vehicles with much higher resolution and performance than their predecessors. The main change is an increase in the number of virtual channels a radar has: similar to pixels in a camera; more is generally better.

For a long time, the industry has made do with 12 virtual channels or less. However, in recent years, tier-one suppliers have started offering radars with 192 virtual channels, and new entrants like Mobileye and Arbe are coming to market with 1,536 and 2,304 virtual channels, respectively. These new and massively powerful radars bring the performance required for level 2+, level 3, and even level 4 autonomous vehicles to operate more reliably.

This is not just vaporware or concepts to show what is possible. These radars are now making their way onto new vehicles. IDTechEx’s industry contacts have reported seeing more and more requests for quotations from OEMs for high channel-count systems. IDTechEx expects that high channel count radars will become commonplace over the next decade.

Big changes required to achieve further improvements

High-channel count radars still have an upper performance limit though. Essentially, if more channels keep getting added, the antenna board needs to get bigger. But, emerging radars with high channel counts are already pretty big, and they can’t grow much further without giving OEMs significant challenges in integrating them.

There are two options for radar performance to keep growing. One – change to a higher frequency. This helps in two ways, firstly, the radar size is linked to operating frequency and a higher frequency would enable smaller sizes, and secondly, higher frequencies enable higher resolutions according to the fundamental physics of imaging. Two – use a distributed antenna. A distributed antenna uses an array of smaller radars placed across the vehicle to create a virtual antenna array much larger than could be integrated with a single box. This solves some of the fundamental issues with growing the performance of radars, however, it requires more radar heads, a more complex system, and different integration headaches for OEMs. Nonetheless, IDTechEx has seen proposed distributed radar systems with 0.01° of angular resolution using these techniques, which is on par with LiDARs.

Automotive radar has been around for a long time, and nearly all new cars shipped today have at least one radar, many have three, and some have even more. Despite this, there is still a lot of change and growth in the radar industry. Side radars drive further growth in the market, the demand for safety and autonomy will lead to higher-performing radars penetrating the industry, and the limitations of physics could drive the adoption of radical new radar technologies.

For full coverage of the market, emerging technologies, and granular 20-year forecasts, see www.IDTechEx.com/Radar. Downloadable sample pages are also available.

For the full portfolio of sensors market research available from IDTechEx, please see www.IDTechEx.com/Research/Sensors.

Dr. James Jeffs

Principal Technology Analyst, IDTechEx

About IDTechEx

IDTechEx provides trusted independent research on emerging technologies and their markets. Since 1999, we have been helping our clients to understand new technologies, their supply chains, market requirements, opportunities and forecasts. For more information, contact [email protected] or visit www.IDTechEx.com.